The authentication of an individual’s income per month or annually is the proof of income letter, also known as an income certificate. Both the income certificate and the proof of income letters are crafted with more or less similar objectives that are to create evidence of an individual’s income per annum. The evidence is crafted to prove the amount of income so they could easily take loans from financial Institutions, be eligible to be facilitated by the government, in school admissions of children, in credit purchase, renting a house, or while finding a new job.

In a few situations, the proof of income letters serves as an employment verification letter that proves the person as an employee of a certain organization. Aside from the employment verification, the proof of income letters effectively serves as a verified person who has the potential to pay rent at a perfect time, and repay the loan without penalty and be a member of any government agency to acquire some facilities given.

Table of Contents

What is a Proof of Income Letter?

A proof of income letter is a formal letter written by an employer to an employee on request. The letter incorporates the salaried amount annually or monthly the employee receives from the company with the proper signature of the employer.

It is a letter that proves the employee’s Salary or income. This letter could also be self-written by those who is not an employee of a company but self-employed.

Sample Proof of Income Letter Templates

|

|

| Download | Download |

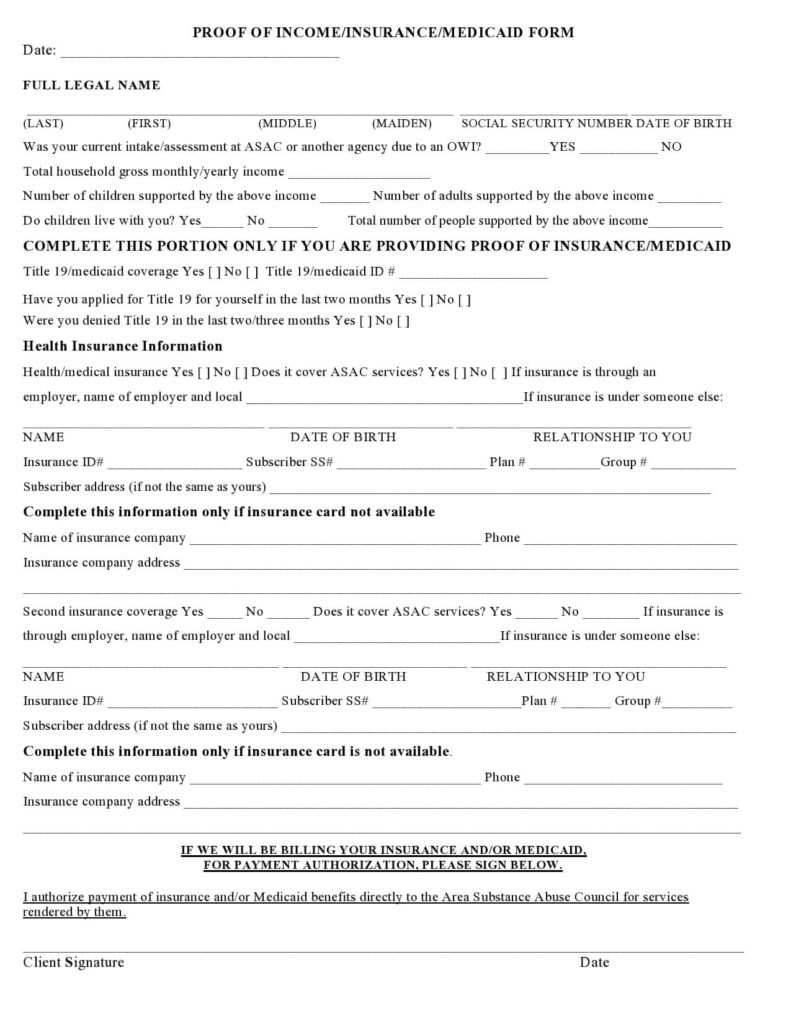

Proof Of Income Form

|

|

| Download | Download |

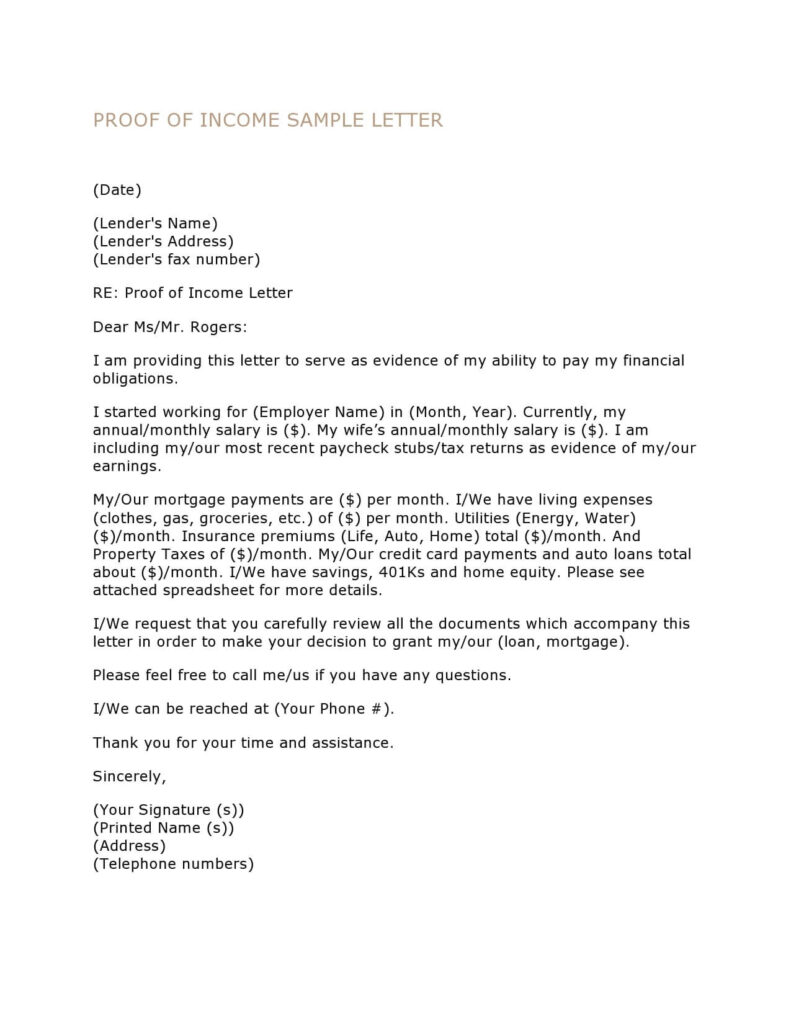

Proof of Income Sample Letter

Proof of Income and Income Verification Letter

The proof of income letter is too regarded as an Income Verification Letter. It acts as evidence or proof of a person’s income statement based on which they could rent an apartment, raise credit, request a loan from a bank, or even become the recipient of a government facility. In several countries, the government provides some deductions for additional facilities to the ones who are below a certain amount of income. In such cases to avail those facilities, the employees request their employer to write a proof of income letter, producing which will make them eligible to access the facility.

In What Situation Proof of Income Letter is Required?

No matter who and where the proof of income has been inquired, it is to see the authentication of your income and how much you earn per annum or a month on average. The verification of employees is crucial when it is connected to serious work, especially when it is closely associated with monetary valuation. The situations that necessitate employee verification or individual verification proof of income letter are asked. To help you more, we have categorized the proof of income letter.

1. Proof of Income Letter for an Employer.

Your new employer or your prospective employer might ask you to prove your income or present the income certificate. It is generally questioned when negotiating compensation. It helps them understand your value, and it is done by the HR or the employer by having a look at your proof of income letter that clearly states the salary you were paid in your previous job. Although it is a bit unfair to judge an employees’ potency using proof of income letters, it is also considered a convenient method to determine the employees’ salary.

2. Proof of Income Letter for Apartment.

The proof of income letter or the income verification letter, whatever you call it, is a letter used by the house owners whose house you want to take on rent. Do you think without a proper verification, they would consider you as their tenant? The answer is no. No person or house owner is ready to rent an apartment or to have a tenant and would hand over the key without knowing the income. You need to present your proof of income letter to the house owner, and if the person is convinced that you will be able to pay the rent at a proper time without fail, you could have the apartment.

3. Proof of Income for Medicaid.

In the United States, the persons with low income Public Health Insurance program that helps them secure their health in long term. The US government has initiated the Medicaid program, especially for the people who are unable to invest in any medical insurance. But the incompetency of the people should not affect their real health because of which proof of income for Medicaid is required by the US government. Since it is only accessible to people with low income, they need to prove their income through the proof of income or the Income Certificate.

4. Proof of Income for a Mortgage.

When in financial stress, often people consider investing some of their personal assets and arrange money in return. In this procedure, although you have to provide certain assets like house documents, gold, or other assets at stake, you require proof of income for a mortgage. The amount of salary you earn per month or per year would help the financial institution know if you will be able to take back your asset and return the money.

4. Proof of Income for the Loan.

A similar cause applies to the loan as well. When you ask or request for a sum of money as a loan from a financial institution or bank, they would like to see the salary or the income you earn per month, based on which the loan will be approved. The individual with low income is generally not allowed a big amount of money as a loan assuming that they wouldn’t be able to repay it at a certain time as the interest would add up more.

Sample Proof On Income Email

Sample Proof On Income Letter From Employer |

Sample Proof On Income Letter Of Salf- Employement |

|

|

| Download | Download |

Sample Proof On Income Declaration |

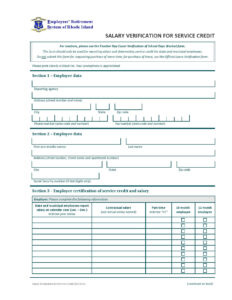

Salary Verification For Service Credit Template |

|

|

| Download | Download |

Fillable Proof of Income Letter Template |

Sample Proof of Salary Financial Statement Letter |

|

|

| Download | Download |

What are the Types of Proof of Income Letters?

Generally, the proof of income letter template has been in two types:

1. Self-written proof of income letter.

2. Proof of income letter written on behalf.

These two categories have different explanations and their causes. The self-written proof of income letter is usually written by the individuals who are self-employed as the proof of income letter written on behalf is the kind of letter template written by an employer of an employee on behalf. Let’s see in detail what is this about.

1. Self-written proof of income letter.

If you are a self-dependent individual and run a company of your own, then the only alternative is to write the proof of income letter or income verification letter by yourself. You could ask no one else to write the letter on your behalf and there is no requirement of it. The general standard states that a self-employed person has the right to craft the proof of income letter by themselves.

In the document, the self-employed individual put the necessary information about their company and the profits earned by them. The income from business shown in the proof of income letters is backed by some financial documents like profit and loss statements and balance sheets of the company that quantify the company’s performance as well.

So the self-employed individual writes the proof of income letter for themselves.

2. Proof of income letter written on behalf.

The proof of income letter from the employer is the proof of income letter written on behalf. When you are employed in a company, you are not allowed to write the proof of income letter by yourself. In such a case, you either have to request your employer to write the income verification letter or ask the HR department to do the favor.

The proof of income letter written on behalf of the individual is the verification that the income statement or other income certificate provided and signed by the authorization is accurate. Seeing such documentation would be enough for the apartment owners to rent their apartment to the individual, convince the financial institution to approve the loan.

But make sure the proof of income letter is written by the person who is associated with your employment, or else it is not regarded as an authentic one. Any reference is not considered as a person who could write the proof of income letter on behalf, therefore it could be either the employer or the head of the department of the company.

Wage And Salary Verification Form

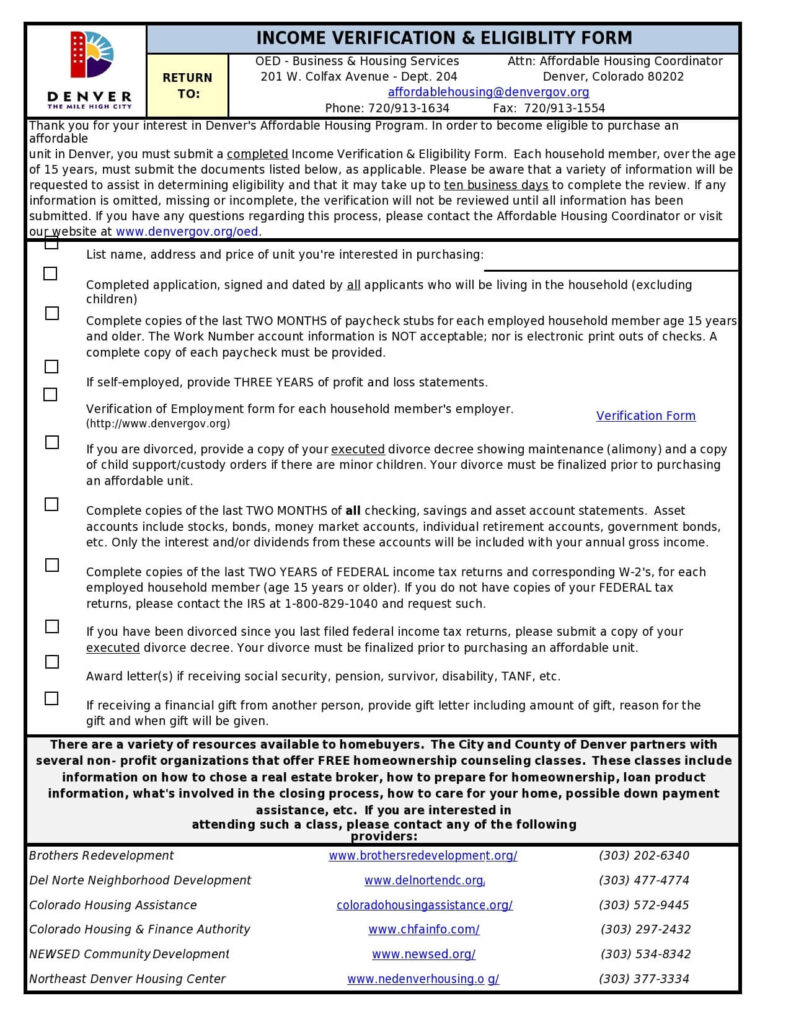

Income Verification And Eligibility Form Template

Income Verification Form Example |

Letter to Verify Income Template |

|

|

| Download | Download |

How to Formulate a Proof of Income Letter?

Being a formal document, the proof of income letter whether written by yourself or by your employer it must be in a correct format. We can ensure that following these guidelines and steps could effectively lead you to a proper proof of income letter appropriate to present in the work field.

These steps are applicable for both types of proof of income letters. In the same section, we have mentioned both the situations and what you can do in the following.

1. Add basic information.

If it is strictly in the form of the letter then it could be addressed to the recipient or for whom you are writing the letter or you want your employer to write the letter. But it is a form of notice, then consider beginning with the title head, the name of the employer, the name for whom the letter is written, employment details like company name, company address, and designation.

If it is a self-written income verification letter, then begin the letter by adding in your company information yours and a few details about it.

2. Mention the purpose of the letter.

To be clear of what the letter is all about after the basic information including the purpose of the letter. Some employers consider avoiding the purpose of the letters in the title head and the information is enough to do the same.

In the case of a self-written proof of income letter sample, you could add two sentences to define the purpose of the letter.

3. Mention the Details of income.

In the next line, provide the details of the income. You could ask your employer to mention the promotions, raise in salary, deductions, and perquisites received from the company. It should be in the proper amount in numbers and words.

In the self-written proof of income letter, since you could not present any income from salary, you need to showcase the profit of three consecutive years.

4. Add in Other sources of income.

The additional sources of income could be mentioned in the proof of income letter. If there is a pension, a gratuity, or any other sources of income you have permanent or you could easily include it in the letter. If it is a consistent thing then it will surely add weight to your letter.

5. Documentations.

With the proof of income letter, there might be some financial documents asked by the landlord or the financial institution. Mention the name of the documentation you have tested along with the letter. It will give the reader clarity and transparency.

6. Put signature and date.

The last step of the proof of income letter is the signature and the date. Check if your employer has signed the document with the proper date. If there is no signature in the authorized blank, the letter will be of no value.

In case of a self-written letter, you will be signing the document along with the date, and there is a partner of yours in the business then you could ask your partner as well to put their initials.

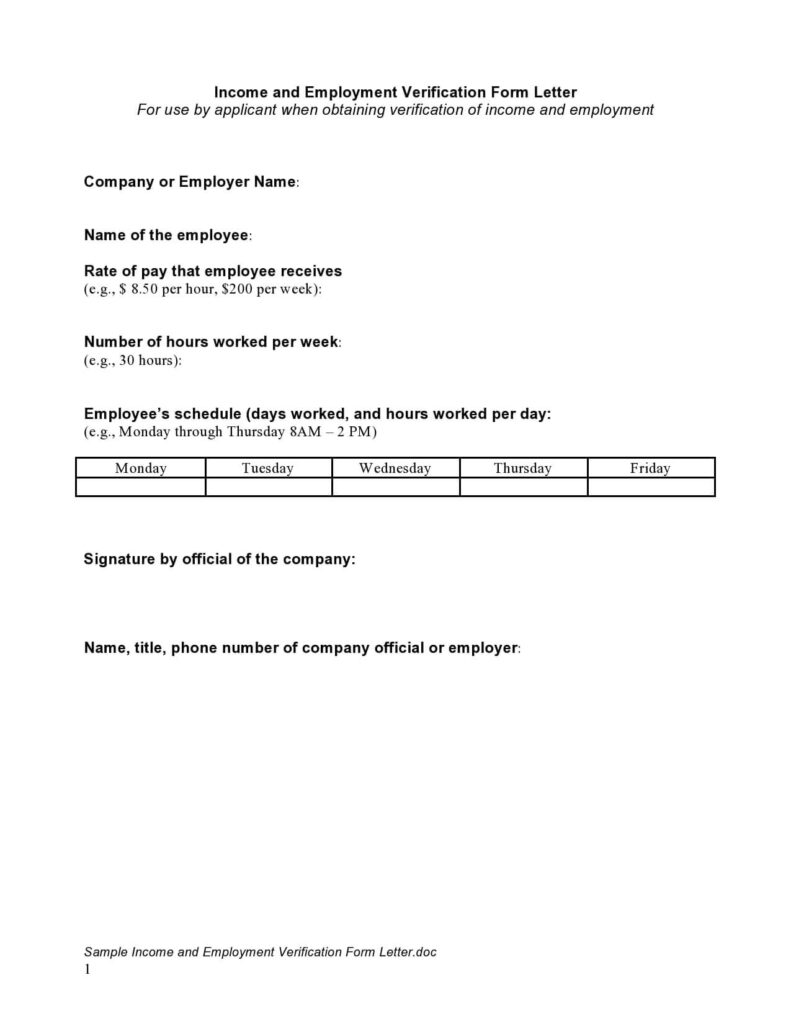

Income And Employment Verification Form Letter Template

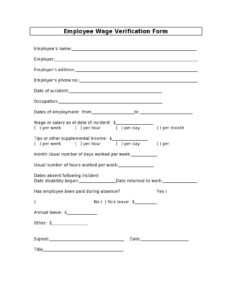

Sample Employee Wage Verification Form |

Sample Income Verification Letter Template |

|

|

| Download | Download |

Proof of income letter doc |

Verification letter for employment |

|

|

| Download | Download |

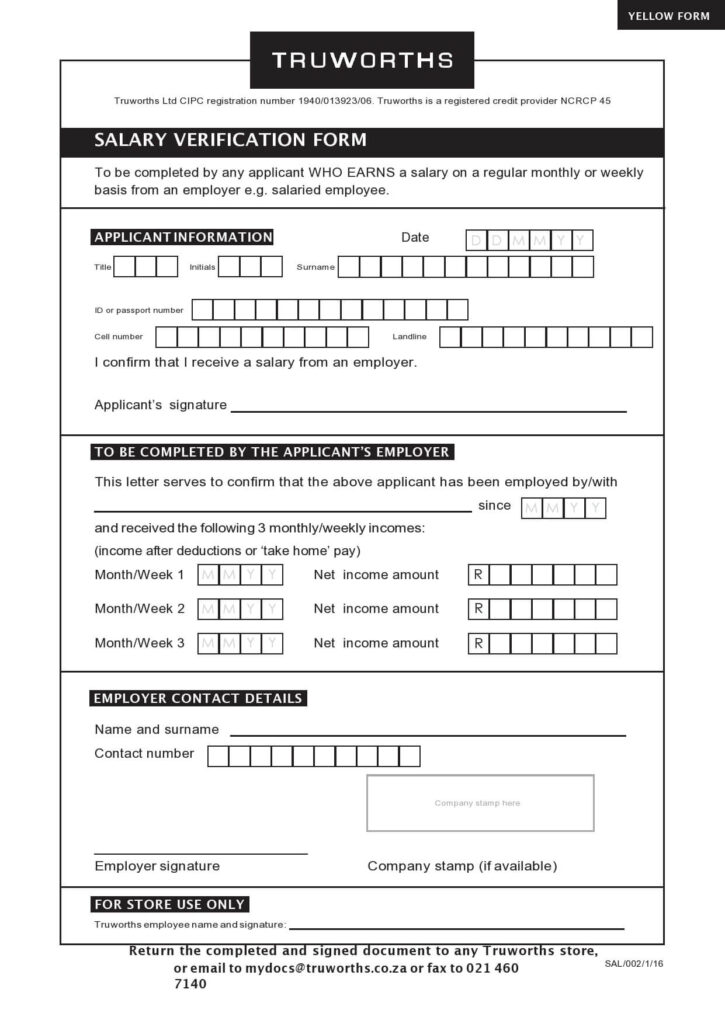

Fillable Salary Verification Form Template

Proof of income letter from family member |

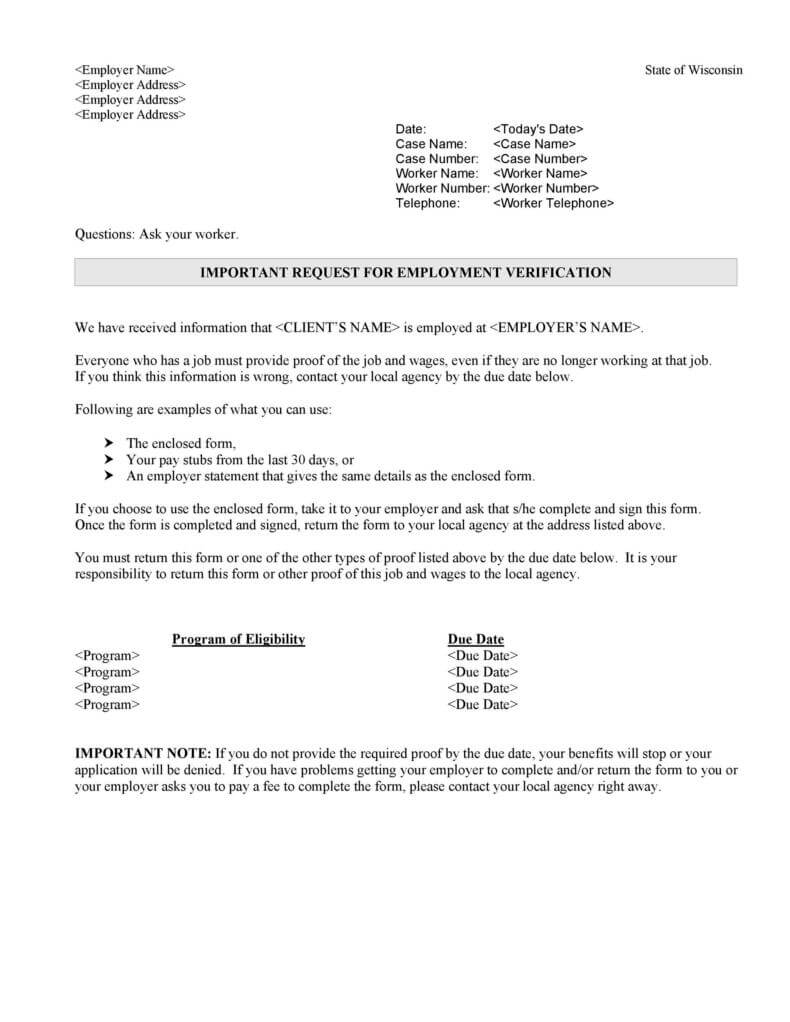

Request for An Employment Verification Letter Template |

|

|

| Download | Download |

Important Request For Employment Verification

Company Verification Letter Template For Income |

Employer Statement of Income Template |

|

|

| Download | Download |

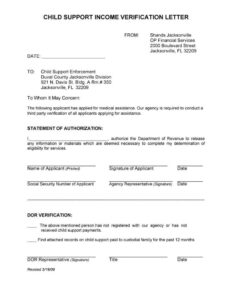

Child Support Income Verification Letter |

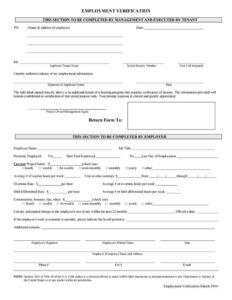

Employment Verification Letter Form |

|

|

| Download | Download |

Salary Certificate Letter Template |

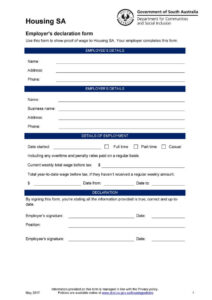

Employer’s Declaration Form Template |

|

|

| Download | Download |

If you have any DMCA issues on this post, please contact us!