Employees who work in an organization are provided with a salary every month. Along with that, a document or certificate is known as Pay Slip/Salary Slip/Certificate is also given to them as proof of remuneration. A payslip is crafted according to the Salary slip format, which may vary depending on the salary components’ variables. The salary employees receive is given after deducting a certain amount from the actual remuneration. When the final net amount is transferred to their respective bank accounts, the amount is not the same as the gross remuneration. This change in the sum is clearly shown on a page after the calculation of deductions and deposits. The page is termed as a Wage slip/ Payroll slip/ Salary statement as per the choice.

In this post, we will show you how to craft an employee Salary Slip or salary certificate format with different variables of salary components. Depending on the company, the nature of the business, or the employee designation of an organization, the salary components may differ, but the overall structure remains the same.

We have made a simple illustrated step-by-step video to show you how to format a salary slip in MS Excel with formulas to automate salary slips for all the employees. Apart from that, we have also listed the editable 42+ Wage slip format in Excel and MS word. Before making any salary slip or crafting the salary slip format, it is essential to understand what salary or wage slip is and the primary purpose.

Table of Contents

What is meant by Salary Slip Or Payslip?

A Salary slip or Payroll slip is an official document that contains a detailed calculation of remuneration given to every organization’s employee. It is evidence of the payment of salaries and wages to the workers. A payroll slip is documented proof of the amount paid by the employer or the organization’s head.

No matter of headcount, a company has to provide a salary certificate or slip to every employee. It is usually issued after the monetary value is transferred to the bank account. Nowadays, the document is often sent via e-mail, but before, the slip was handed over manually.

|

|

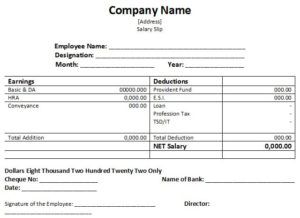

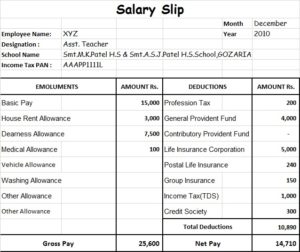

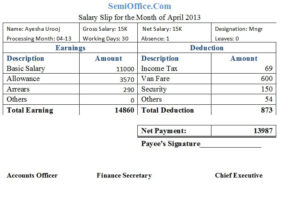

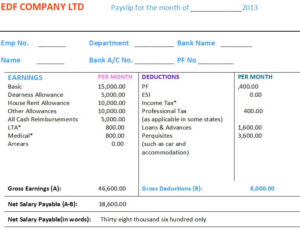

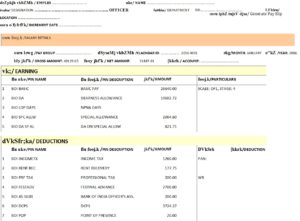

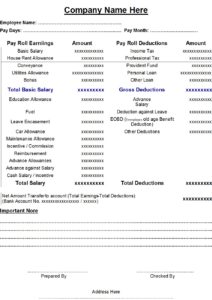

Simple Salary Slip Format

|

|

Components Of a Standard Salary Slip Format

The components of a salary slip is divided into two parts: Income and Deductions.

-

Income / Earnings

This is the first major component of a salary slip. Under the earnings-

- Basic Salary,

- Dearness Allowance,

- Medical Allowance,

- House rent allowance,

- Performance Allowance

- and other allowances are included.

-

Deductions: Several deductions

Under this head come all the deduction components of the Salary

- Employees Provident Fund (EPF),

- Professional Tax (PT)

- Tax Deductible at Source (TDS)

- Loan repayment

Sub components of salary slip. (Income)

COMPONENTS OF CALCULATION OF GROSS INCOME OR GROSS SALARY

- Basic Salary: Basic salary can also be termed as the principal amount. This is the major element of the income as it comprises out about 40% of salary. On the basis of the basic salary, further calculations are done. It is the base of payslip and other Salary components are determined on this basis of this.

- Dearness Allowance (DA): Payslip term it as DA. It is provided to the government employees. The main motive behind it is to reduce the effect of inflation on workers. It is an important element in tax calculation. A certain percentage is allotted upon which the following calculation is done. DA is added to the basic salary as per the percentage.

- Medical Allowance: A) A certain percentage of money is provided to the employees as a medical allowance. This amount of money is also added with Basic Salary and DA. During tax calculations, they are taken into account. This type of medical allowance can not be claimed as a deduction from taxable income as reimbursement. It is treated as fully taxable under and the head of ‘Income from Other Sources’.B) There is another type which is called Medical Reimbursement that only triggers if an employee meets any medical expenses in a financial year and submits proper proof of medical expenses.

- House Rent Allowance (HRA): Some well-established companies offer the allowance of house rent as per the location. If the employee lives in a house of rent, a certain amount of the rent is paid by the company itself. This amount is added while calculating net remuneration on the payslip. The income Tax file calculates it under their laws. As per section (10) of the Income Tax Act, one can claim it as a part of deduction as well.

- Other Allowances: Apart from these, there are several other allowances provided by companies that are evenly added to the Basic Pay Salary before any deductions. Such allowances are- Children Education Allowance, Transport Allowance, and Car Allowance, Conveyance or Transport Allowance, Overtime Allowance, Leave Travel Allowance (LTA), Performance Bonus, . It also includes other sources of income like Bonus and Commission. Employers often categorize it under separate heads or combine them together under “Other Allowances”.

CALCULATION OF DEDUCTIONS

A deduction is an expense deducted from the Gross income to trim down the actual amount which is subjected to tax. These deductions are subtracted from the income by the company. Using several allowable subtractions in the form of deposits, the net amount are lessened.

- Employees Provident Fund (EPF): EPF is a fund of a scheme created for the employees to accumulate a certain amount of money deducted from the monthly salary. On retiring, the employees are provided the lump sum amount that accumulated over the years. Basically, 12% of the Basic Salary is deducted and deposited into this fund. No matter how much the amount, the employer contributes the equal amount to the fund. As it falls under the deductions, they are exempted from tax calculations.

- Professional Tax: This is levied on individuals who are earning an amount every month. It is applicable for employees, private tutors, traders. It is calculated on the individual’s tax slab and is valid only in some states of India.

- Tax Deducted at Source (TDS): TDS is an amount deducted as a tax payable on behalf of the Income Tax Department by the employer of the company. If you want to reduce the tax deduction, you can invest in a tax-saving scheme on the submission of a few documents.

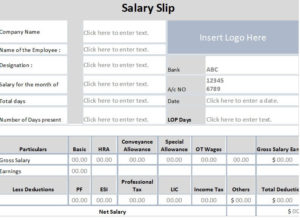

OTHER NECESSARY COMPONENTS

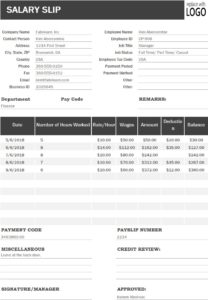

Apart from these components, there are other elements too that are to be included. Necessary elements like- Details of employees, and the descriptions of the job along with certain codes and numbers are to be included.

- Personal Details of the employee: For identification purposes, all the information of the employee’s like- Name of the employee, address and phone number.

- Further employee information: Other details like- Bank Name, Bank account number, Branch name, PAN number, ESIC number, PF number, and PF UAN.

- Employee number or Payroll number: Employee number is a number allotted to every employee for identification purposes. If any dispute arises, they use this Employee number to fund out the details on the computer.

- Tax Code: The tax code is issued by the Government to specify the rate of percentage the individual is taxed at. Companies often find it necessary to be included in the salary slip.

- Business Unit: The name of the business unit or branch the employee is working in.

- The total number of working days: Mention the total number of days the company was open; excluding the holidays.

- Effective working days: Among the number of working days, state the number of days the employee has worked for.

- Absent days: In this column, put the number of days the employee was absent for.

After finishing all the elements, make a space to put up the Net Salary again. Mention the salary in number and then on the next line, write it in words. It will clear out any confusion as it will be written twice.

For the companies, the employees they hire are categorized in different groups as per their level of work. Few of them create separate salary templates and according to the category, they are utilized. Different organizations have come up with different types of templates having a unique format. Though the objective is the same, still a fair amount of difference is noticed. Some payslips have some more additional features than the other ones. We must know about the kinds of templates already available in the market. In order to make an original version, let’s see a few of the existing formats.

|

|

| Download Salary Slip | Download Free Salary Slip |

Salary Slip Excel Template |

Simple Salary Slip Format in Excel |

|

|

|

|

| Download |

|

|

|

| Download | Download |

|

|

| Download | Download |

|

|

| Download | Download |

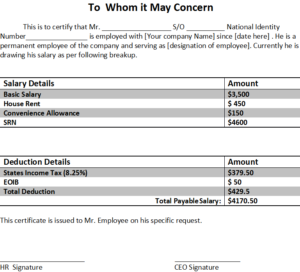

What is the Significance of Salary Slips?

To make our work easier, we have adopted different methods of calculations. Those calculations are further recorded on a page to store it for future use. Such as Salary slip- it is an important document for both the company and the employees. It must have served well for both parties during the complex situations. So here we mention a few importance and advantages we draw from the salary slips:

- Evidence of employment: A salary slip acts a legal proof of a person’s existing job. The job offer letter produced by the company itself does not prove the existence of the job till then. As the salary slip mentions the date and the net amount of remuneration last drawn, it would serve as evidence. While applying for a visa or to various universities, one may have to produce such a document as proof.

- Preparation of Income Tax Return File: Filing Income Tax Return has been made compulsory by the Government, no matter what the salary is. The employees receiving less than the allocated limit also have to prepare the file so that the Government gets to know your salary. A salary slip includes all the details required to calculate tax. So, it is the major document to play a role in tax calculations.

- Helps to access services of loan or credit card: The interested person can only apply for a credit card or loan, if he/she has the salary slip. The financial institution asks for the salary slip as a major document for submission. The net amount of your salary slip would decide whether you have the ability to pay the debt within the stipulated time. Thus, it is an essential reason for having the salary slip as this would bring you the services of mortgage, loan and credit card facilities.

- Access to Government facilities: Our Government has made many bills for the services of citizens. They are categorized as per the annual income of a person. By producing the salary certificate, one can easily access to the free services provided by the Government.

- For further employment: A person may feel that he/she deserves a better payslip and can apply for other jobs. During the course, if the person gets selected, the previous salary slip would validate his/her participation in a well-established organization.

A person working in a company are well aware of the importance of Salary slip. No matter which designation they hold, it is the responsibility of the company to provide a salary slip every month to every employee.

|

|

| Download | Download |

|

|

| Download | Download |

|

|

| Download | Download |

How To Create A Standard /Basic Salary Slip Excel Templates?

Nearly every company has its own salary slip templates. Either they are downloaded from cyberspace or made by own. If you are working in an organization or about to join the company who would be responsible for crafting a salary slip, you must know the method of creating a Salary slip. It would help you obtain additional skills relating to the basic works of an organization. Anytime, the authorities may search for organizational personnel who are well aware of this skill. That time you can be the person asking to create it. To do so, you have to know the steps and guidelines of creating a template.

Have a look at this video and we are quite certain you will have the better understanding of the visual presentation.

Salary Slip Sample |

Format of Salary Slip in Word |

|

|

| Download | Download |

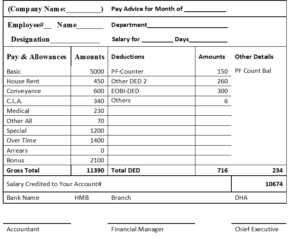

Private Job Salary Slip Format |

MS Word Salary Slip Format |

|

|

| Download | Download |

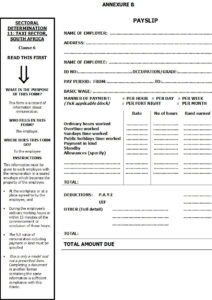

Salary Slip Format As Per Factory Act |

Salary Slip Format As Per Payment of Wages Act |

|

|

| Download | Download |

Blank Salary Slip Format Template |

Basic Salary Slip Format |

|

|

| Download | Download |

Basic Understanding of Salary Slip Formulas and Calculations:

| Particulars | Formula |

| Taxable Salary Income | Total Income = (Gross Salary + Other Income) – Combined Deductions |

| Cost To Company Or CTC= Emloyee’s Total Salary Package Offered by the Company | Gross Salary + PF + Gratuity (Total Cost to The Company) |

| Gross Salary | (All Salary income components offered by the company to its employees) = Basic Salary + HRA + Other Allowances ( Allowances may differ based on the company’s operational structure) |

| Net Salary | (Net take home Salary) =Basic Salary + Allowances + HRA – Income Tax – Employer’s Provident Fund – Professional Tax |

Salary Slip Format In PDF |

Salary Slip Format For Bank Loan |

|

|

| Download | Download |

Indian Salary Slip Format:

The basic salary slip format or structure remains the same for almost all companies across the world but depending on the economy and income tax calculation structure, the components varies a bit. Here is the basic salary slip format with components that nearly almost all payslip formats feature:

- Company Name in bold letter, preferably on the top of the salary slip page. Logo and address are also on the prominent places.

- Salary slip for the period and Payroll slip generation date.

- Employee’s financial and identity details, namely PAN Card/Aadhar Card, Bank account details

- Employee Provident Fund or EPF account number & 12-digit unique UAN number

- Gross Salary components in each separate column.

- Total working days (Orver time if applicable).

- All deductions in each separate column.

- Gross Salary pay

- Income tax calculation and amount

- Net salary pay (Both in Number and Words)

Example Salary Slip Format for Central Govt Employees |

Salary Slip Format For Contract Employees |

|

|

| Download | Download |

Salary Slip Format in Excel With Formula |

Simple Salary Slip Format for Small Organisation |

|

|

| Download | Download |

Pay Slip Format for Hospital |

Salary Slip Format For PVT LTD Company |

|

|

| Download | Download |