In a business, aside from the large payments, several small transactions or expenditures like postage, travel expenses, stationery, telephone charges, cartage, convenience, sundries, etc, have to be made daily. These are petty(small) expenditures recorded in petty cash log templates and forms. These transactions of small amounts are recorded in the petty cash book and not in the cash book as it would become large. Therefore, to maintain these expenses in a smaller amount regarded as petty transactions, they are recorded in petty cash log templates. The petty cashier is entrusted and appointed to handle these small payments and register them in the petty cash book.

The procedure of registering the transactions in the petty cash log template is simple. However, there are different types of petty cash log templates majorly classified into- simple and analytical. There are more to this category that will be discovered later in the content. But in whichever form the petty cash log templet is crafted, it helps monitor the petty expenditures in the business daily and prevents from going overlooked.

Table of Contents

What is a Petty Cash Log?

A petty cash book is the book of accounting to record the petty expenses. It is a kind of cash book prepared by a petty cashier to register the small payments made in business daily. It includes expenditures such as conveyance, cartage, postage and courier, stationery, general expenses, repair, traveling expenses, Telegram expenses, etc.

After a week or a month of transactions, the petty cashier is provided the petty cash imprest, the vouchers, and viewing the cash vouchers, they record the petty expenses in the petty cash log templates.

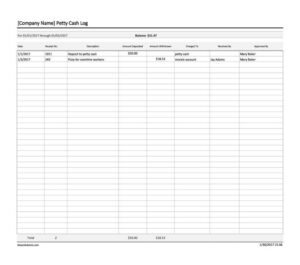

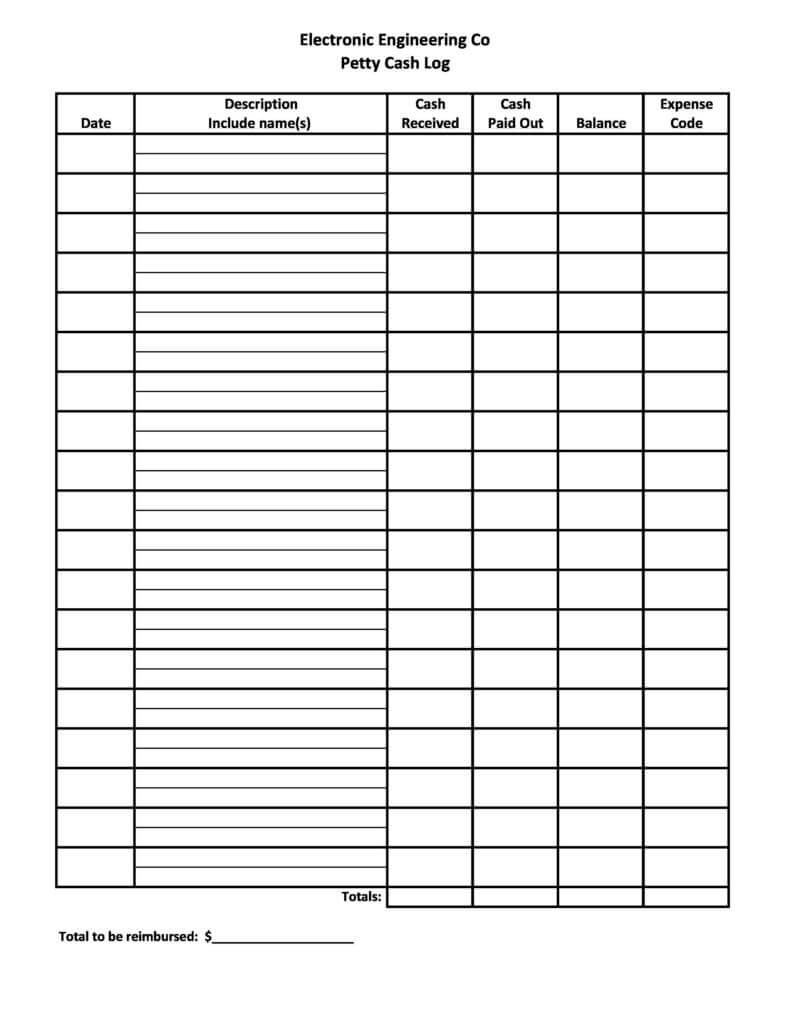

Petty Cash Log Templates & Forms

|

|

| Download | Download |

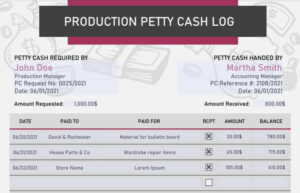

Restaurant Petty Cash Log Template

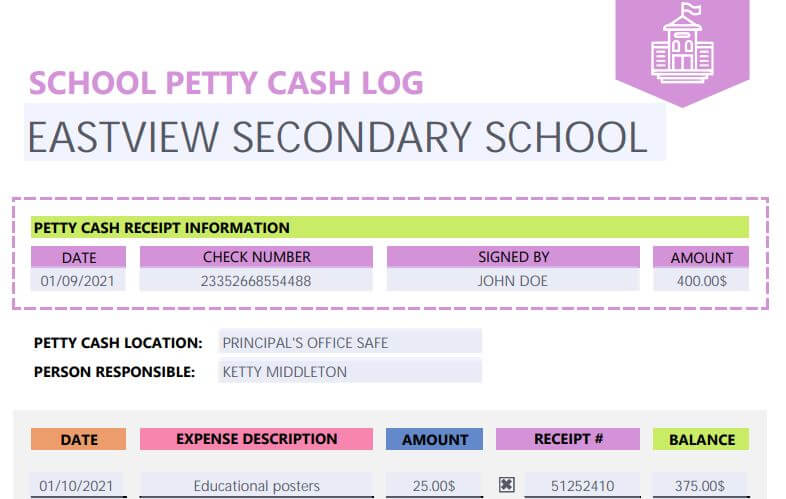

School Petty Cash Log

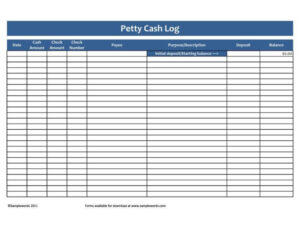

Simple Petty Cash Log |

Weekly Petty Cash Log |

|

|

| Download | Download |

What are the Advantages of Petty Cash Log?

The record of petty expenses in the petty cash log template and forms has reasons and advantages. Instead of filing it up in the cash book with other cash transactions, the petty expenses are provided a separate accounting book handled manually. It is because it doesn’t require computerized actions, and still has benefits to share.

By maintaining the petty cash book, you are benefited from the following:

1. Convenient to prepare the ledger.

One of the significant advantages is the convenience of preparing ledger accounts. The totals of the petty cash log templates and forms are used to post into the ledger. It helps in avoiding unnecessary details and the total directly into the ledger.

2. Delegation of work.

Handling the cash book and the petty cash book is easy when a different individual is associated. The appointment of the petty cashier is one of the reasons. When the work is divided, it is done efficiently and helps in avoiding any error. The transactions of petty cash are usually large, and if included in the cash book itself, it would become voluminous; therefore, the delegation of work or the division of work help tackle both easily.

3. Saves Time.

The main individual appointed to keep account of the cash transactions and handle the cash book is different from the petty cashier, and thus the work is completed faster and thereby save time.

4. Control over small payments.

Usually, the property transactions of getting overlooked while focusing on the major transactions in huge amounts. Disregarding such transactions disrupts the calculation and ultimately results in wrong accounting. Therefore the inclusion of petty cash log templates and form help to get control over the small payments.

Printable Petty Cash Log |

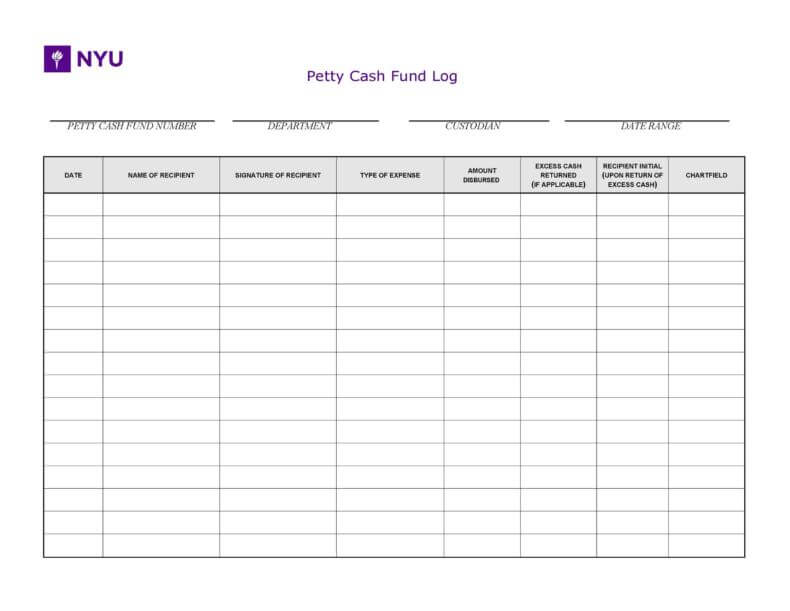

Petty Cash Fund Log |

|

|

| Download | Download |

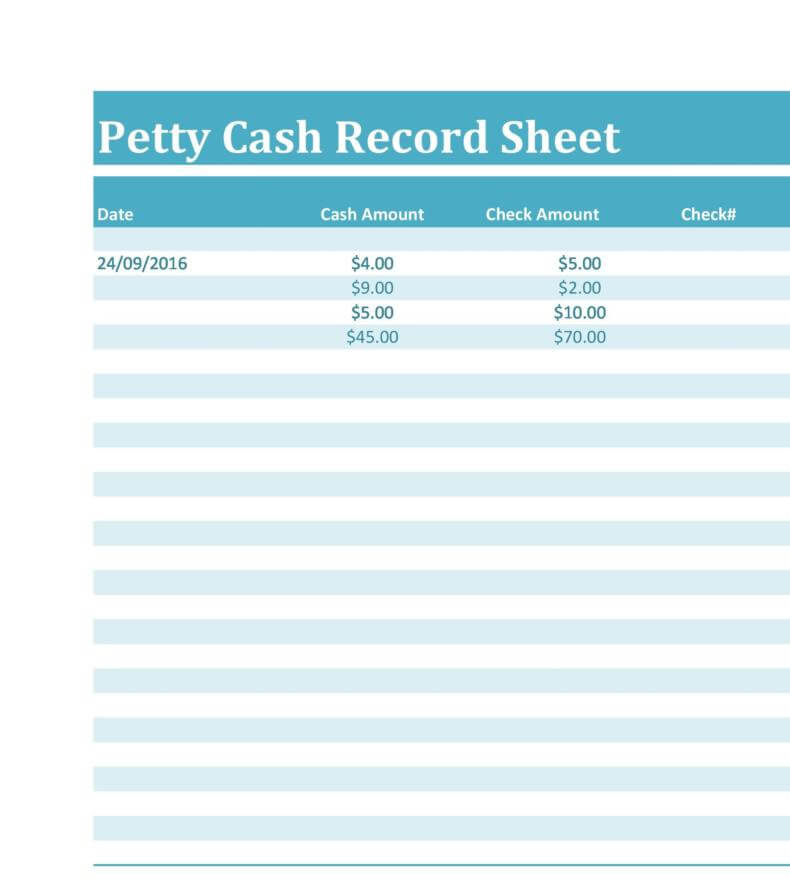

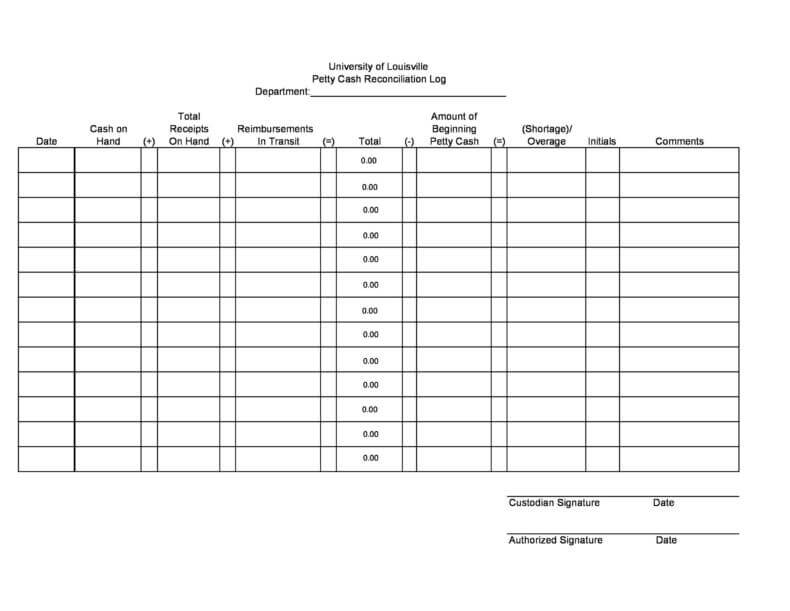

Petty Cash Transaction Register

Petty Cash Record Sheet

Petty Cash Template Log in Excel |

Petty Cash Reconciliation Template |

|

|

| Download | Download |

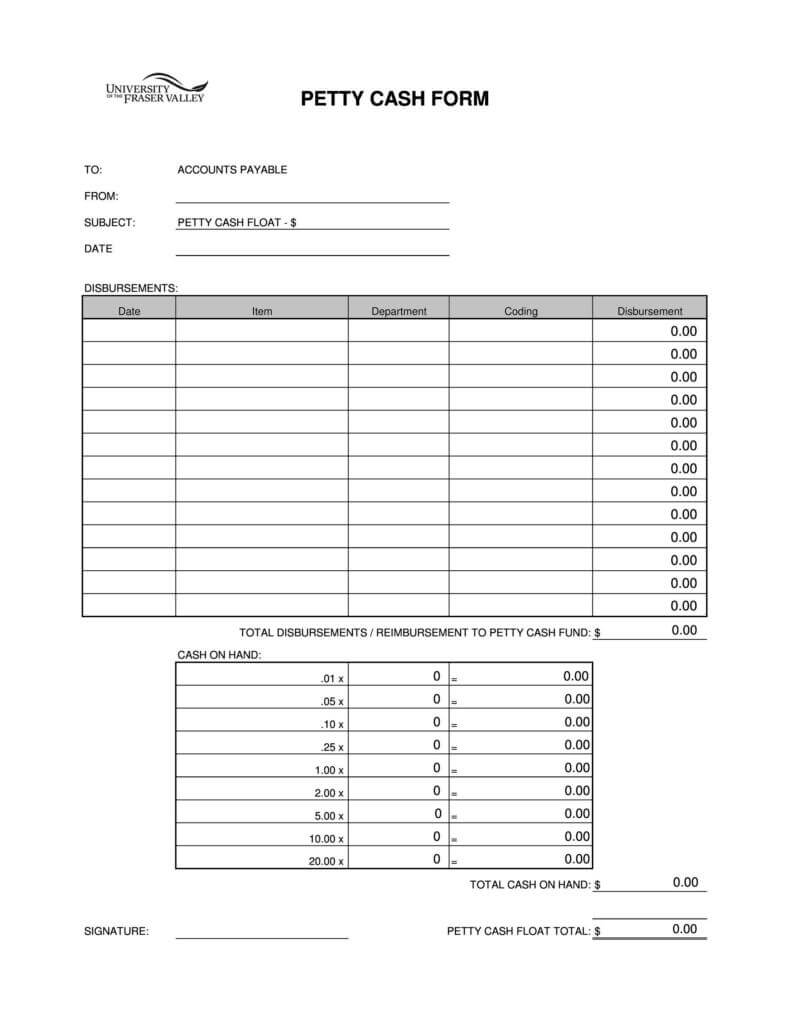

Petty Fund Cash Template

What are the Types of Petty Cash Books?

The petty cash log template is usually maintained by the ordinary system or by the imprest system. The imprest is one of the systems ordinarily used, but there exist other types of petty cash recording systems as well that you need to learn so you could format the log in your convenient way.

These are the types of petty cash logs used in different cases.

1. Simple petty cash log.

2. Analytical petty cash log.

3. Columnar petty cash log.

4. Imprest petty cash log.

1. Simple petty cash log.

The simple petty cash log format is identical to the cash book. It is of the same format maintained while recording the cash transactions. There are two sides-debit and credit. The column of the debit side is used to record the amount received, where is the right side which, is the credit side of the simple petty cash log template is used to record the petty cash payments.

It contains the following columns:

a. Amount received- to record the receipts.

b. Ledger folio.

c. Cashbook folio.

d. Date.

e. Particulars- to record the payments.

f. Ledger folio.

g. Voucher number.

h. Amount paid.

Mechanism-

The process of registering the transactions in the simple petty cash log is the same as the process of posting transactions in the cash book. The amount received from the chief cashier for petty cash is recorded on the debit side i.e. On the column ” amount received”.

The petty cash payments are recorded on the credit side of the petty cash log, with its date in the “date” column, description in the “particulars” column, a serial number of the voucher in the column “voucher number,” and the amount in “amount paid”. After the completion of the record, if the amount of payments and the amount received resembles then it is considered that the amount given was fully spent for the petty cash transactions.

2. Analytical petty cash log.

The format of the analytical petty cash log is different from that of the simple cash log. In the analytical petty cash book, the debit side of the log has only one column whereas all the others are shifted to the right side of the petty cash book.

Generally, it has two sides, of which the left side is used to record the cash receipt from the main cashier. The right side of the analytical petty cash log is used to record the petty payments.

Mechanism-

In the analytical petty cash log, separate columns are provided to record the payments. For each expenditure item, there are separate columns allotted and while recording the particular payments and its amount is registered on its particular allotment place.

For example, you need to record the conveyance charge of Rs.200, the cartage of Rs. 150, the postage of Rs. 400. The amount of conveyance is posted on the column under conveyance. In the same process, the cartage of Rs.150 is posted under the column head cartage, and the same goes for the postage.

The petty cash advance to the petty cash by the main cashier is recorded on the debit side of the petty cash log. After the end of posting of the payments, the total expenses paid resembles the total of each column of expenditure. If it doesn’t match, then there must be an error in the posting. Check if there is an error and then balance the two columns of the book, and transfer the balance on the receipt side of the petty cash log.

3. Columnar petty cash log.

The columnar petty cash log template format is similar to the analytical petty cashbook template. It has quite a lot of columns to record the daily expenses. It also consists of the debit and credit side to record the payments and receipt. The payment received by the head cashier is recorded on the debit side, whereas the credit site contains the petty transactions paid.

The amount is recorded in the amount column and the details of the transactions are recorded in the particular column. The difference in the payment and the received is regarded as the Debit balance.

4. Imprest petty cash log.

The imprest system of recording the petty transactions is a system of pain advance money to the petty cashier in the beginning and repaying the amount spent timely. It is similar to the columnar log template. It has one particular column on the debit side and a lot of other columns to record the expenditures on the credit side.

Under this system, an estimated amount required for Peri transactions say for a week or a fortnight or a month is handed over to the petty cashier by the chief cashier. It is used to cover the expenditures for the given period. After the duration is over the petty cashier submits the expenditure statement to the head cashier. It makes sure the petty cash expenditures do not exceed the amount provided to the cashier.

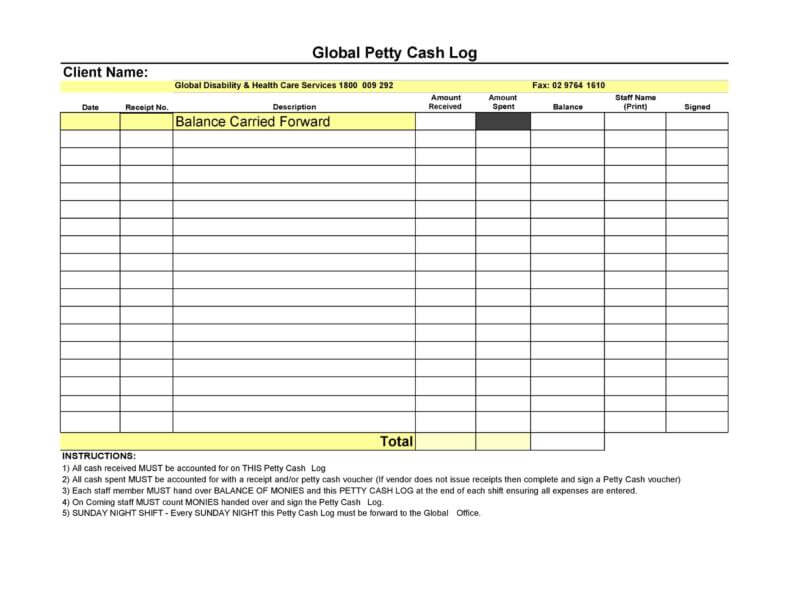

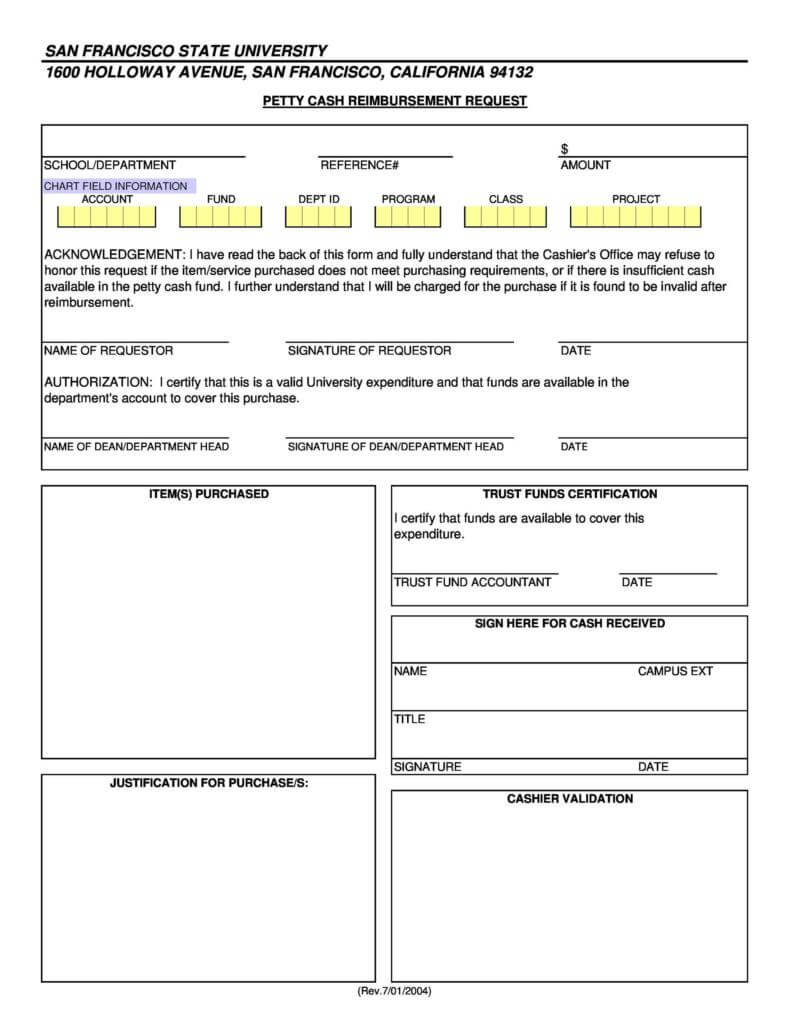

Global Petty Cash Log

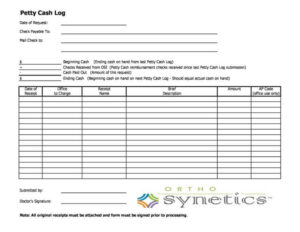

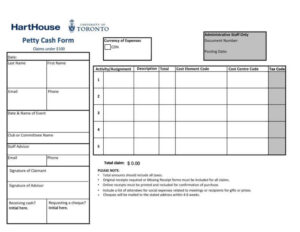

Petty Cash Voucher |

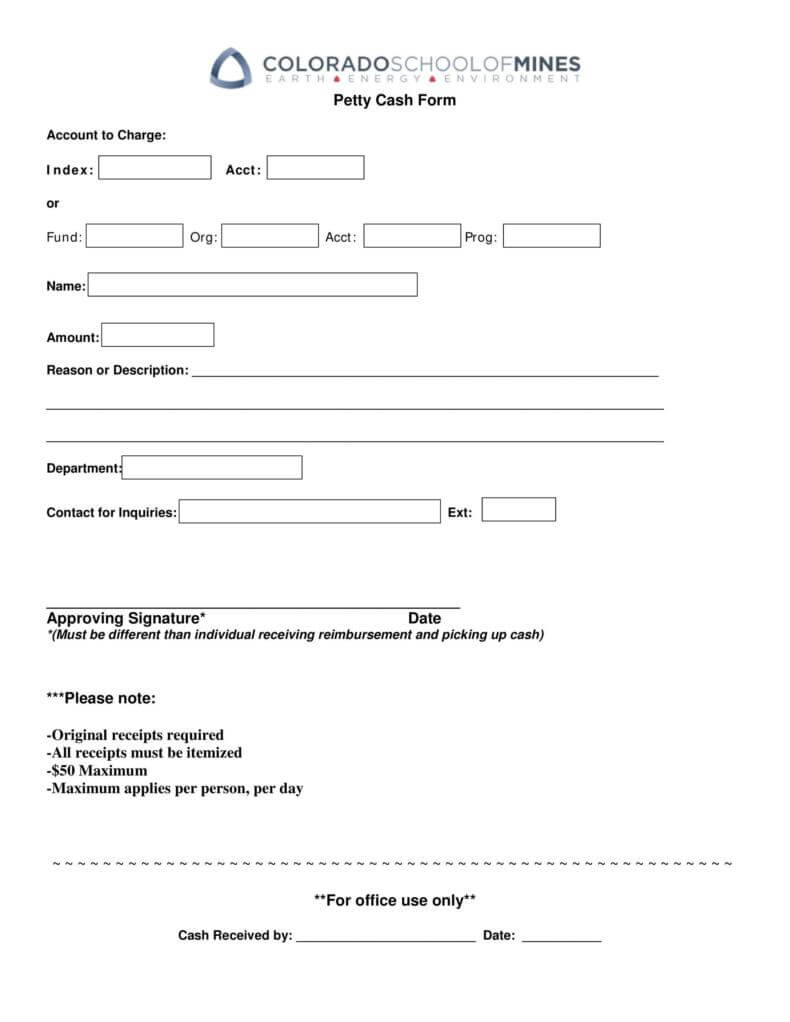

Petty Cash Form Log |

|

|

| Download | Download |

Departmental Petty Cash Log

Printable Petty Cash Log |

Download Petty Cash Log Template |

|

|

| Download | Download |

Advantages of using imprest system of petty cash log.

1. Using the imprest system to record the petty transactions will ensure that you have control over errors. The petty cash log is regularly monitored by the cashier, thereby ensuring the record is accurate.

2. It also gives control over petty expenses. It is a good system since the petty cashier is not able to spend more than the cash allotted.

3. The imprest system of petty cash log ensures control over fraud. Under this system, no individual is allowed to draw cash, or make any payments, therefore there is no fraudulent case in petty cash transactions.

Whether it is the necessity of monitoring the small transactions in the business, decluttering the cash book, convenience to prepare the ledger accounts, you could easily craft any form of petty cash log template and form or download.

How to Establish an Effective Petty Cash System?

Petty cash is liquid cash prone to insignificant expenditures and theft. Engagement of this cash in petty expenses is the reason due to which the employees consider not recording the petty expenses, therefore, resulting in theft and expenditures on other things rather than in business. So a business must successfully create a petty cash system, so the methodologies operate in a specific method and the money is spent on the required items and not on random stuff.

a. Setting up a fixed amount of cash for petty items.

The businesses must keep a fixed amount of cash for the petty expenditures. The fixation of excessive petty amounts for the expenditures leads to the random acquisition of office items rather than a business. But the petty cash is for the business however, a few of the portions could be invested for the office expenses if required. Anyways, a big amount when fixed for petty expenditure is more likely to theft and discrepancies. Therefore it is recommended to verify that the amount fixed for the petty expenditures is small and sufficient.

b. Specify the expenditures.

When a business knows the spaces where the petty cash would be invested, they could effectively establish a petty budget and specify the places that could be the point of petty cash. You could even set up the places where the fund could be utilized or else it would have a tendency to be spent on the things that are not actually necessary or fall under the budget of office expenses. Many times, the cash is spent on unnecessary elements in such a case one needs to check the matter and keep the cache in control so it is not utilized in any non-essential element.

c. Record the petty expenditures.

The money spent on insignificant items is often not recorded in the petty cash book. It is quite inefficient of your employee to not record even the small expenses on the book wondering it would make no difference in the business. But even a small penny means a lot to any kind of business therefore it must be ensured that employees of the organization responsible for the petty cash system must keep a record of the trivial items. Advise your employees to be on their toes, or operate a team for monthly verification. It would and sure that the expense is fixed for the petty items is spent only on the required and the right things.

d. Keep your hand on the expenses.

Allowing the employees to access the petty fund means allowing them to make any fraudulent activities or theft. Therefore it is recommended to allow the employees who have been in the organization for the long-term and trustable. Although today no one is worth the trust due to the negativity and the mind of theft as per your convenience could hire a person who would keep an eye on the expenses done from the petty fund.

Petty cash template word

Petty Cash Distursement Log |

Petty cash log template free PDF Download |

|

|

| Download | Download |

|

|

| Download | Download |

|

|

| Download | Download |

|

|

| Download | Download |

If you have any DMCA issues on this post, please contact us!