Payment Terms Template | 27+ Payment Agreement Terms and Conditions Sample: Payment terms/agreement or conditions is an absolutely critical part of any formal loan or any commercial transaction. When crafted right, this document can be used as a legal document and presented in court as evidence. This document represents the receiving party of the loan or the buyer agrees to pay a certain amount compounded with the interest rates (included) in an agreed period of time. So while crafting this important document, all the necessary elements should be included, which thoroughly states the agreement and conditions. From a buyer’s or loan receiver’s perspective, giving assent to any payment terms or agreement means agreeing upon certain conditions, acknowledgment of the loan and returning the money in a given period of time with due interest (if any).

You should consider using Payment Terms Template under the below-given circumstances:

- When you are giving money to someone as la oan

- You are taking money from someone as a loan

- When you make a business transaction and want to bind both parties with certain payment terms

- When you are about to receive or give Installment Payment.

Having a detailed Payment Terms Template document that carries all the necessary and important conditions, terms and payment agreements will make things organized and will help you to get rid of any unnecessary problems and any confusion. When failing to abide by the contract by any party, the other party can take the necessary action to resolve the issue with the help of this document. It is always a prudent act to play safe than be sorry when a financial transaction is made by making the receiving party agrees to sign payment terms agreement. It is also an important document for the receiving party of the loan that he can protect himself from any additional demand which is not mentioned in the payment agreement form.

Table of Contents

Payment Terms Template

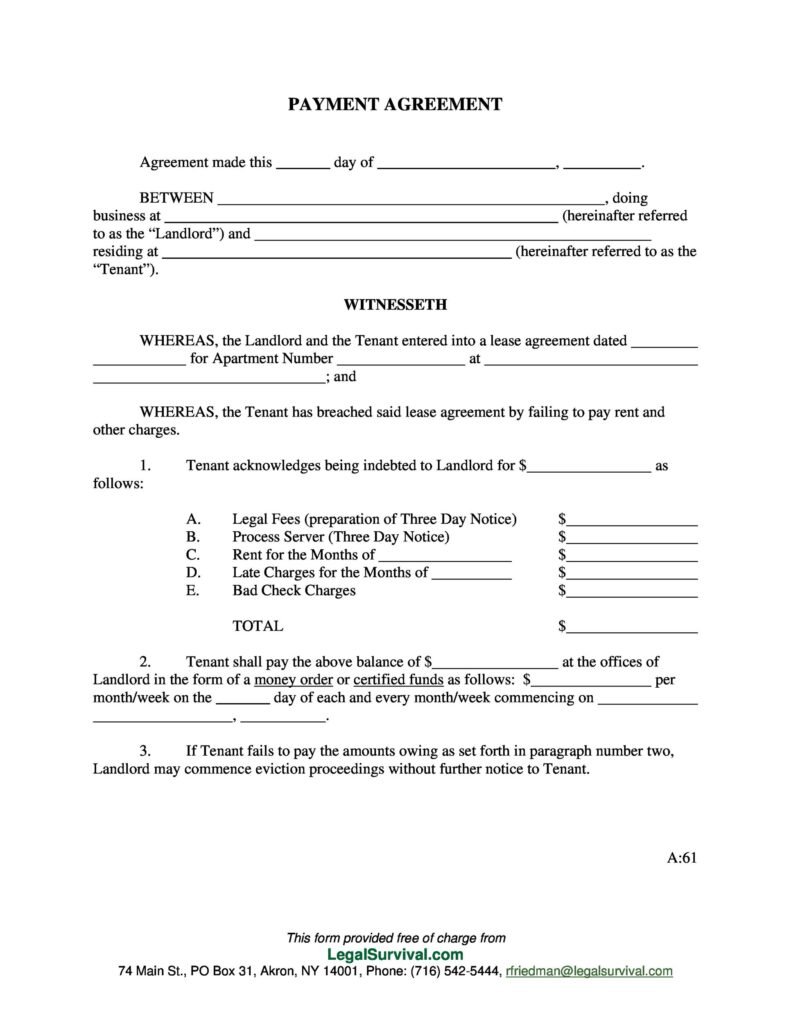

Community Health Center Payment agreement Template in

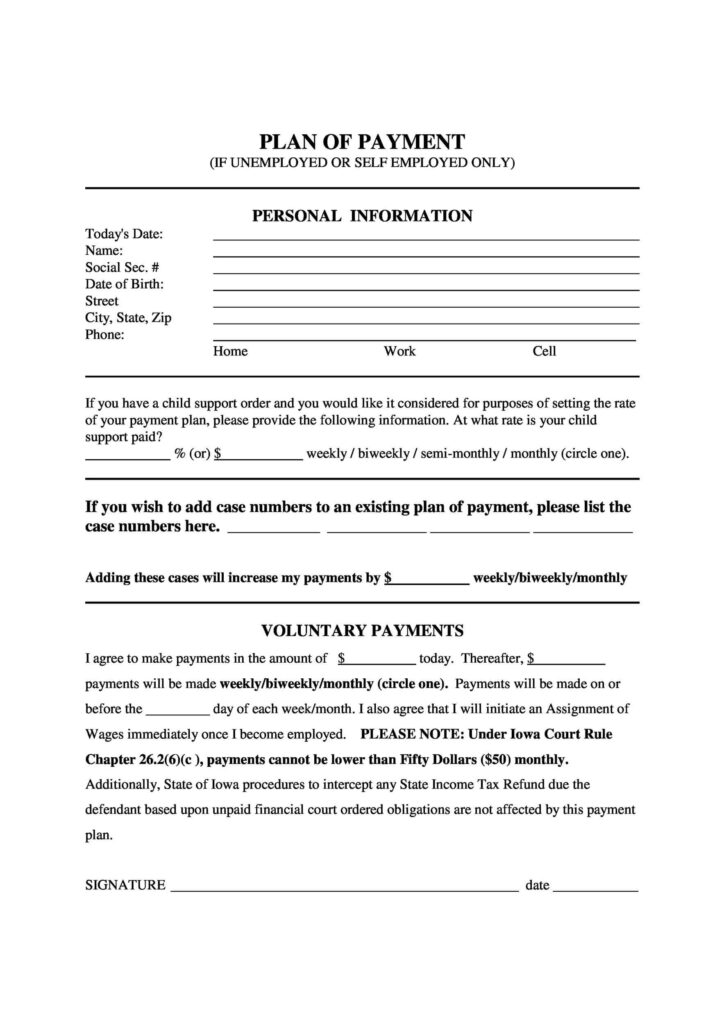

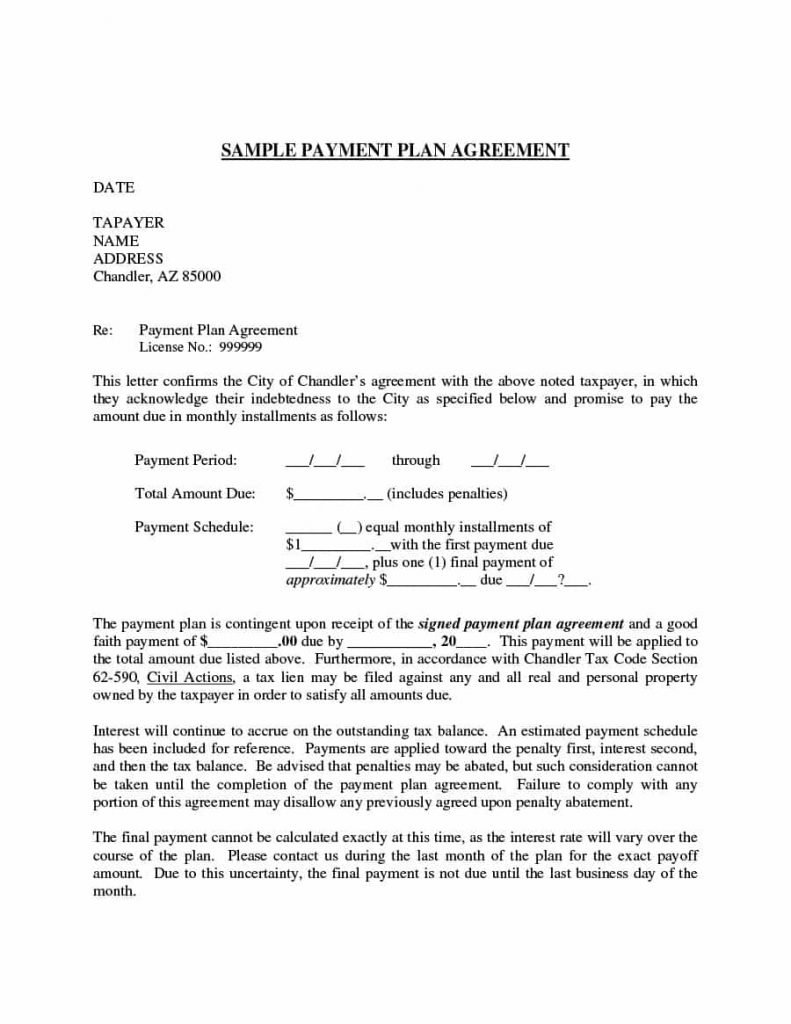

Sample Payment Plan Agreement in PDF (Sample Payment Terms Template)

(Sample Payment Terms Template)

Fee Payment Agreement in PDF

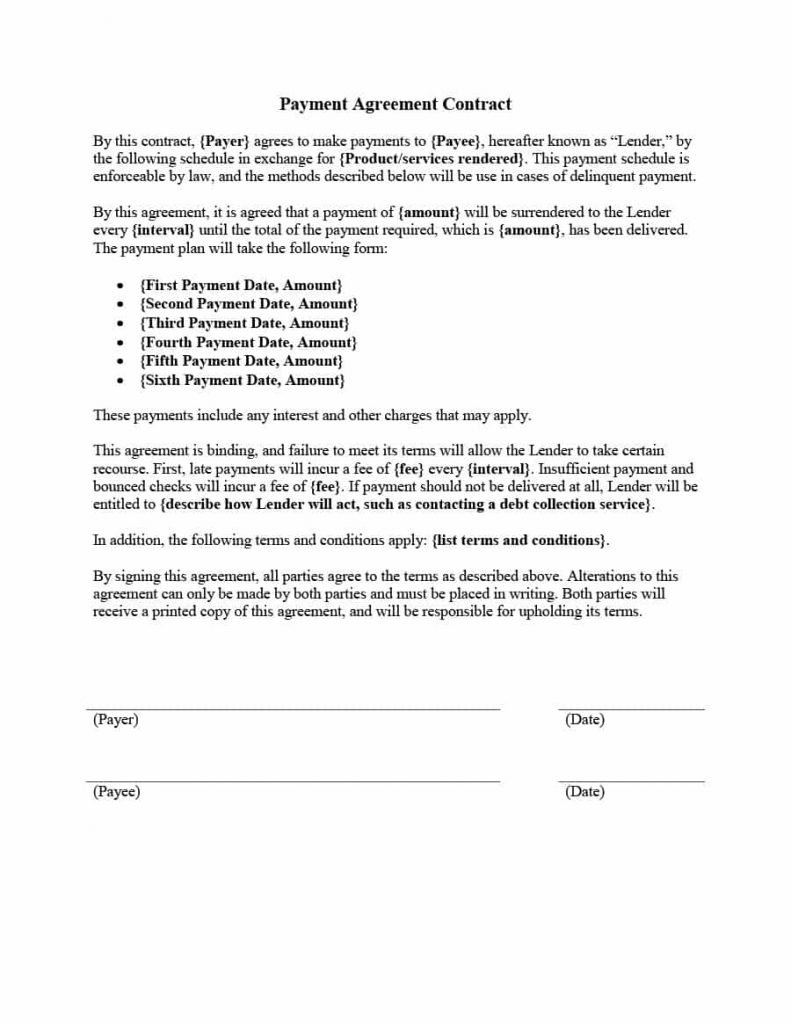

Payment Agreement Contract template in MS Word

The Mechanism of Payment terms: How Payment Terms work?

When a transaction of money takes place in the form of a loan, basically, a payment terms and agreement is made between two parties where it is clearly mentioned when and how the money should be returned by the borrower. In this document, both parties come to a common ground and agreed upon the payment terms. Depending upon the loan and financial amount, this whole process might take some time and there are several steps to be performed before the final agreement is made. Here are some different circumstances where payment terms and agreement document is drafted:

- The first and most common cause is when a lender agrees to lend money to the borrower, he creates a payment terms document including every detail of the financial transaction like loan amount, interest rates, the period of time and by when and how the money should be returned to the lender.

- For business institutions, the process is a bit more complex. Before any financial transaction is performed, the willing borrower may have to submit a financial transaction record basically in the form of a Bank statement along with other business documents to the lender, which is basically an NBFC or bank. The financial institution then performs the regular scrutiny of the documents provided by the willing borrower and decides whether the individual or business has the capability to return the money with due interest.

- If that fits into their quality checking criteria, then the finance company may lend money to the borrower and draft the payment terms document with all required details of the loan agreement, how and by when money should be returned along with any collateral deposit against the hypothecation of the loan amount.

- There could be a negotiation between two parties on the payment terms, interest rates, duration of the payment and collateral amount, etc. When both parties agree to certain terms, finally, the payment agreement and payment terms document are crafted and upon being signed by both parties, the loan amount is disbursed to the buyer’s account.

These are the general steps that are practiced when lending money and securing the payment back with interest. If the lending amount is negligible or way too low, then it might not be required (though it is a good practice) but for a huge or hefty amount, there is no way one should ignore initiating Payment Agreement terms and condition document. When the transaction has occurred between two private parties, they might create the payment terms document depending on the understanding between them and the nature of the transaction.

Whereas, in case of a financial institution acting as a party, this documentation (Payment Terms Template) is mandatory along with a whole host of other documents. Financial institution drafts the document in case of their involvement but in case of a private transaction either can make the agreement draft and send to the other party for their approval. Once both parties agree upon the terms and agreement, they can finalize the documentation by signing the document, including their stamps if applicable.

Payment terms and conditions sample letter:

Statistics show there are a whole host of disputes and misunderstandings that occur every year due to the lack of proper payment terms and condition documentation, which lead to court cases between parties and that one has to end up seeking help from the legislation.

As a buyer, you would not want to land into that situation where you have been dragged into the court for disregarding the payment obligations and failing to meet the terms of the payment. From a seller’s perspective, it is absolutely critical to state the payment agreement, terms and conditions clearly in papers and make sure that the buyer agrees upon that before the initiation of the financial transaction.

Temporary Payment Arrangement Letter Example

Sample Letter Agreement on Repayment Schedule

Professional Services Agreement Letter of Agreement Master Template

Sample letter of Phased Payment and Installment Arrangements

Sample Agreement Letter for Rent Payment Template in PDF

When should You issue an Agreement Letter for Payment?

There are a couple of main reasons and circumstances where an Agreement letter for payment is a must and should be created to keep the interest intact for both parties. The dimensions of the Financial transaction vary quite a lot for both private and corporate sectors and a well-crafted Payment letter agreement can be really useful. Here we have listed some of the main objectives of the Agreement Letter for Payment:

- To avoid verbal miscommunication and future disputes, a written agreement letter can be created. It will eradicate the chances of any verbal miscommunication and both the party can be assured of financial transactions, responsibilities and liabilities. This document can even be treated as a legal document if there is any dispute happens.

- If we make a verbal agreement and mutually agree upon any payment terms, there is a strong possibility that any party may ask for a falsified or hypothetical claim which they have not been agreed upon in the first place. In that situation, there is no legal document that can protect the interest of any party. But if at the time of making the agreement, they also create a letter for payment agreement that can eradicate the issue of any falsified claim in the future. Either party can not defy or claim any financial amount, percentage or period of time which is not mentioned in the written agreement.

- The interest of both the party can be equally be protected by the document.

- Any financial loan transaction comes with a fixed or conditional repayment period term. Within the given term, the borrower has to pay a certain or variable amount as interest to the lender and at the time of expiry or maturity borrower has to settle the transaction either by paying the remaining amount or the full principal with outstanding interest. The whole details can be written in a latter of agreement and that both parties can follow without any dispute.

Sample Request of Balance Payment Agreement Letter Sample in

Standard Sample letter of agreement for Payment Example

Sample Demand for Payment Agreement Letter

Payment Terms & Payment Plan Request Information Letter

Sample Payment term and Plan Agreement Letter

How to craft payment terms and conditions with sample templates

Payment terms and agreement is a critical and important document. There could be several small yet extremely important conditions in a standard sales invoices with payment terms document. While crafting an invoice payment terms make sure it ensures the payment against the goods sold or the service rendered and minimize the dispute between parties.

Depending on the particular condition, some of the components of all payment terms may vary from one another but there are some basic parameters that all payment terms document must hold that safeguard the financial transaction against the loan repayment, payment against goods or service being sold.

Here are some of the basic yet critical aspect one should keep in mind while drafting invoice payment terms:

-

Clear Cut Understanding:

At the time of drafting terms of payment and making the agreement, one should keep the document clear and state all the parameters straight forward that misunderstanding can be avoided. Different clauses should also be mentioned categorically when a certain condition is not fulfilled. For example, if the borrower misses an installment payment, what is the circumstances or how many penalties should be levied. Or, can the borrower use any other mode of repayment than the usual bank transfer or check. Or if there any chance of prepayment or not.

2. Consequences of Non-Compliance by either party:

This is another very important part of any standard Payment Agreement Terms and Conditions document. There are certain cases where either of the party may tend not to obey the stated agreement. So it should be clearly mentioned in the document what would be the consequences of breaching the contract and not following the agreement.

3. Terms & Conditions: Governing Law:

Agreement document must clearly state the jurisdictions, Terms & Conditions and governing laws along with the governing authority in case of any dispute arises regarding any matter mainly the repayment.

4. Time Duration of the agreement:

Loan repayment should always come with a predefined terminal value by when the repayment should be made by the borrower and settle the loan. If by any chance loan is not repaid in the mentioned stipulated time frame, what would be the circumstances that should also be mentioned in the draft document clearly.

Installment Payment Agreement & Conditions

Loan Repayment Contract Agreement with Conditions

Monthly Payment Plan Template ( With Agreement)

Simple Payment Agreement Template in PDF

Money agreement between two parties: Simple Payment Contract

1. Agreement:

Right at the beginning of the template, it should clarify what this document is for and what both parties have agreed upon. Further, the document should clearly list down specified terms and conditions for different circumstances and their consequences. Liability of both the parties, conditions, loan repayment agreements, specification, duration of repayment and mode of payment along with penalties in case of delayed payment are the important heads to keep in mind.

2. Terms of product or service sale:

Most of the time, misunderstanding or disagreement takes place due to a lack of definitive or ambiguous terms of the product or service sale. But once you have all the important proposition listed in the invoice sale agreement in the form of product or service cost, the number of quantity being exchanged, quantity of the product, payment terms, interest percentage, mode of repayment, duration of the loan or repayment period etc. misunderstanding and disagreement can be easily avoided.

3. Return or Replacement Policy:

The buyer’s obligation only initiates when the good or service sold by the seller is being accepted by the buyer. There are certain circumstances where goods and services provided by the seller may not remain at the utmost quality for which the buyer has paid for or initiated the transaction. Disagreement may take place between parties in those scenarios.

In order to avoid that, the Buyer should make sure the incorporation of the return policy in the invoice agreement. Whether good should be returned fully or in case of inadequate performance seller provides required support that goods or services restore back the product quality that they can perform the way they should be.

On the other hand, detailed mention of return and replacement policy will safeguard the seller’s interest. There can also be an incident where due to the lack of proper mention of the return or replacement policy, buyer can take advantage of the loophole and ask for replacement or return of the product after using.

4. Invoice Instant payment agreement or COD or Cash Sale:

There is another very well-known payment term where the service or goods provider claims payments immediately as soon as the transaction is being authorized. They are referred to as a Cash sale and COD (Cash on delivery).

Cash on delivery is one of the renowned payment methods in the eCommerce industry where buyers can opt-in for the option of payment upon delivery of the product at their given address. Whereas cash sale referred to cash hthat as been paid as soon as the product or service has been handed over to the buyer.

5) Net 7, Net 10, Net 30 payment:

Depending on the nature of the transaction, invoice deadlines can be decided for different customer payment terms. But whatever terms you choose has a direct impact on business health cash flow management. Understanding different payment terms would help you to avoid hidden traps of customer payment terms. Here we are tried to explain 3 most common invoice deadline payment terms options:

- Net 30 terms: When net 30-day payment terms is active, the customer is liable to pay the net amount in 30 days from the date of the transaction which is the total invoice amount. Customers should make sure to pay fully before the provider starts charging interest and late fees to the pending amount.

- Net 60 Payment terms: Under net 60 days payment terms customer should pay the net invoice amount before late payment finance charge has levied on the due amount

-

Net 90 terms: 90 day payment terms is offered when both parties agrees on the condition that the buyer would make the due payment within 90 days from the date of the actual transaction.

There are certain cases where incentives are offered by the service or product seller to the customer that they intend to prepone the payment. The seller can clearly mention the condition such as ” paying within twenty-five days (when payment terms is net 30 days) and get 2 percent discount on invoice amount” that buyers know the advantages of prepayment

Simple Payment Agreement Between Two Parties

Payment Agreement Letter Sample

Contract payment terms and conditions sample:

Payment is critical for any transaction to be fulfilled and close successfully. The terms and conditions of payment directly impact on business cash liquidity. For example, cash sale brings the cash instantly and cash liquidity stays at a great comfort label. Whereas, when credit is given to the buyer, seller has to wait a certain period of time 7/10/14/30 days for cash inflow which indeed strains the cash liquidity and impact on profitability at the same time.

At the time of drafting the contract payment terms ( with the help of Payment Terms Templates) between parties involved, points should also be clear and precise. The wording should cover all the grounds, even for commercial lease agreement, credit card payment agreement, or any third party liability, along with the clear drafting of payment scheudule. Here are some sample contract payment terms and condition with Payment Terms Templates.

Payment Contract Agreement Sample