Your business’s future income and losses are forecasted using final projection templates. The existing business uses the past financial records of the business to bring up the new aspect. The cash flow statements of previous financial years, profit and loss statements, operating expenses existing help the financial advisors to bring up the new estimation of the financial data to forecast the future incomes and expenditures.

For the startups, there are no existing documents to follow, it rests completely on educational guess and other business planning tools. The financial projection helps the startups to plan the budget, estimate the break-even point and the curve thereafter, and set benchmarks. Both the startup and the existing company required the financial projections template when they needed to foresee the business potential.

Table of Contents

What is a Financial Projection?

A financial projection is a financial document consisting of the estimated values of revenue and expenditures of the business. Using financial elements like payroll, sales, operating expenses, cash flow statement, balance sheet the assumptions of the business are forecasted.

The purpose of the financial projection is to convince the investors and the leaders of the business to be in it by putting the estimated ground of business potential. Through the financial projection of future years, a business can showcase future business growth and operate accordingly.

Sample Financial Projections Templates

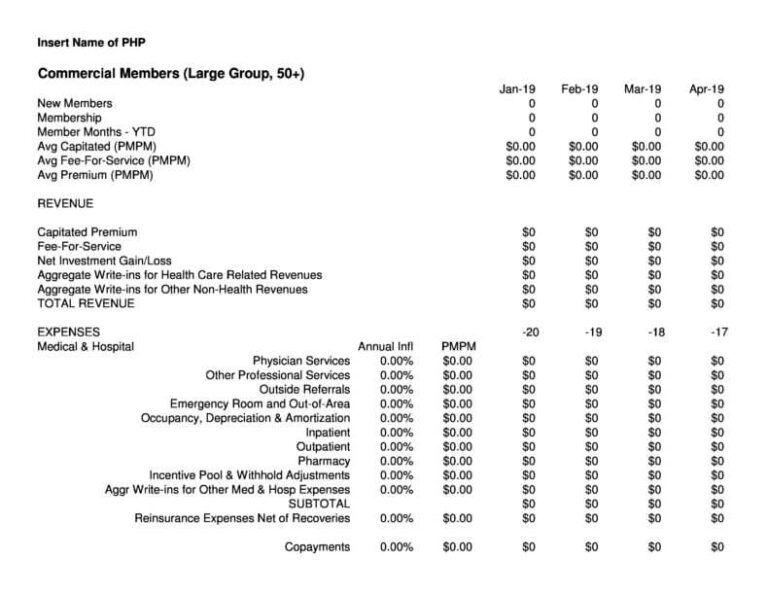

Financial plan template |

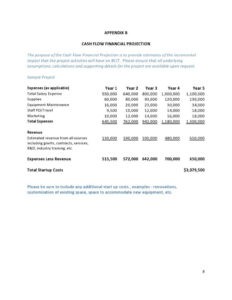

Start-up Expense Analysis Financial Projections template |

|

|

| Download | Download |

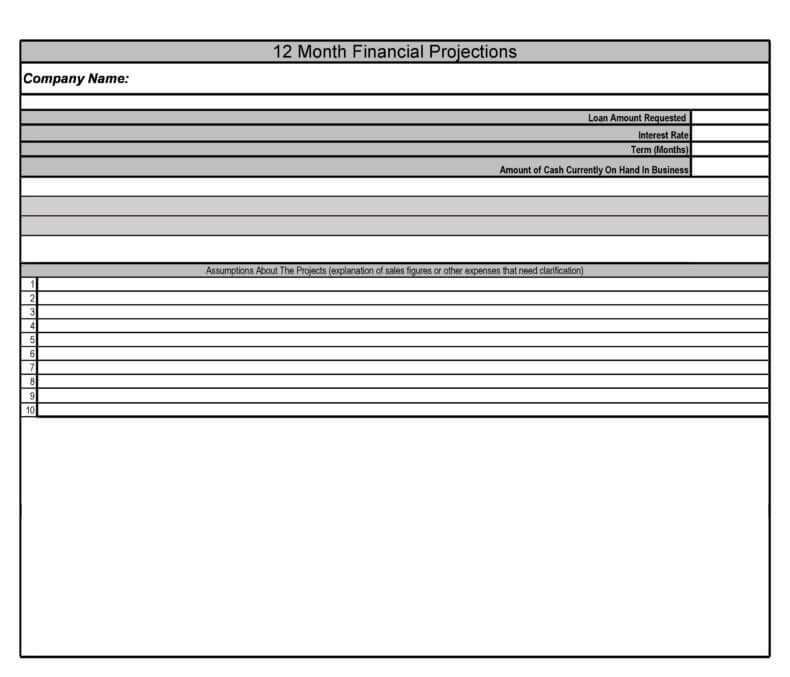

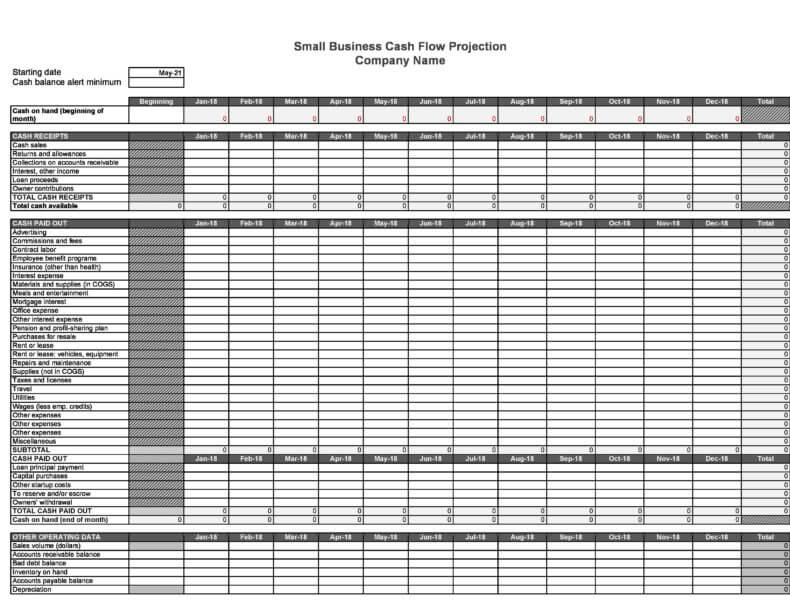

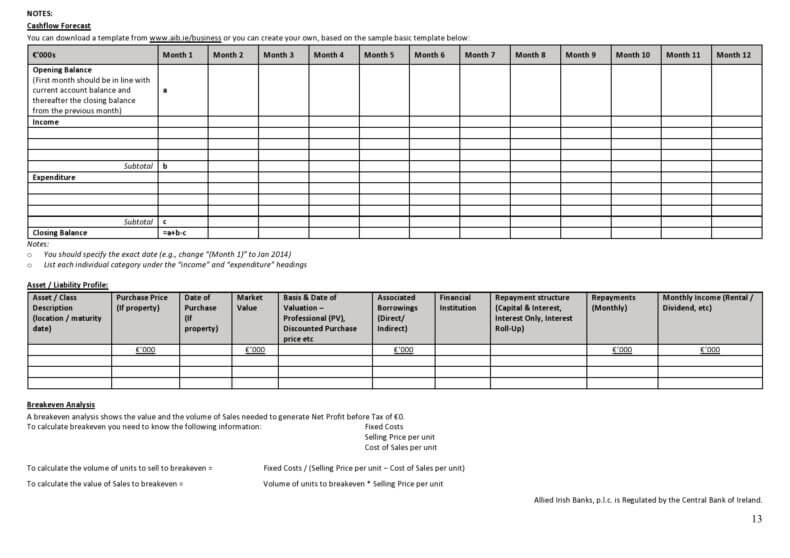

12 Month Financial Projections template

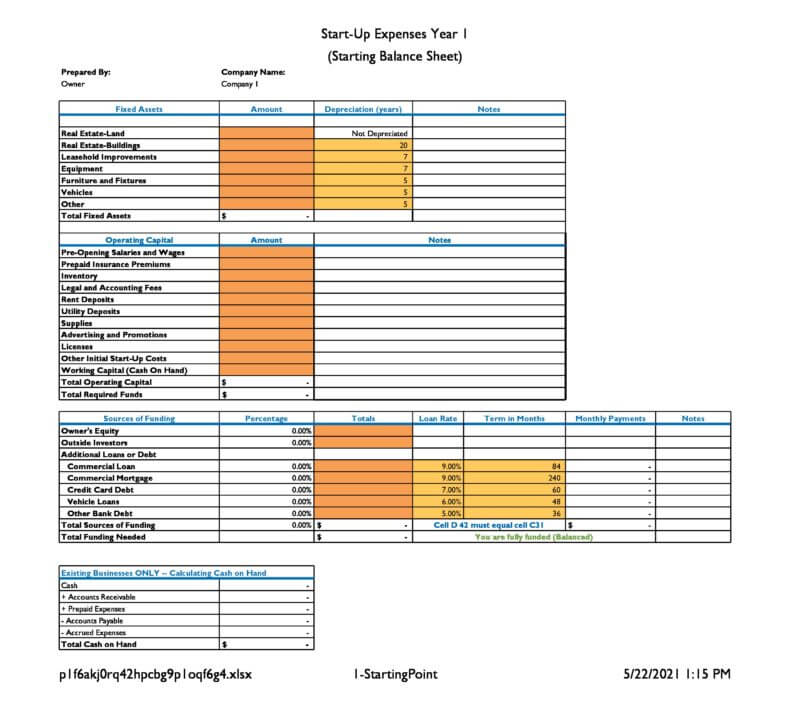

Start-up Cost & Sources of Funding Financial Projections template

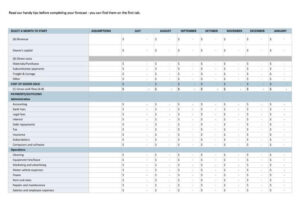

Cash FLow Financial Projections template |

Sales Forecast Financial Projections template |

|

|

| Download | Download |

Small Business Renenue Projections Template

On What Basis the Financial Document is Projected?

The financial ingredients or the accounting books maintained in a firm to keep track of the financial activities in the business are incorporated in a financial projections template. In the 3-year financial projection template free, both the existing financial value and the estimated value are recorded, and later it is checked if the two values are close enough or resemble; accordingly it is adjusted.

- Payroll-Current and Estimated.

- Sales- current and estimated.

- Operating expenses- past and estimated.

- Cash flow statement.

- Income statement.

- Balance sheet.

- Financial ratio analysis.

- Break-even analysis.

- Cost of goods sold.

- Amortization and depreciation of business.

This set of financial documents are called upon to refer to the past financial information of at least 3 years and using the same the financial advisors or the financial forecasters, do the process and find the estimated sales, balance sheet, cash flow statement, cost of goods sold, financial ratio and others.

A detailed description of each of the elements will be a greater clarification to you and would help you know why it is required.

Financial Model Income Statement Projection Template |

Financial Statements Projection Template |

|

|

| Download | Download |

Projected Consolidated Balance Sheet Template

Business Financial Plan |

Financial projections for startups |

|

|

| Download | Download |

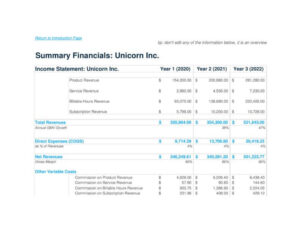

Revenue Projection Summery

5 year Financial Plan Projection Template

Why do you Need a Financial Projection?

The financial projection has always benefited from proffering into a business. Different businesses receive advantages in different ways due to their scenarios.

Let’s see the basic reasons due to which a business invests in a financial projections template.

1. A financial projection helps portray the business’s potential and its growth. The investors and the shareholders remain in a business if they find the business in growth.

2. The existing business houses get a clear view of the future income and expenditures, and they could operate the business accordingly.

3. For existing companies, the financial projections template act as a are tracking tool that also helps to set goals.

4. The startup companies get assistance to outline their budget, get an estimation of when it would curve up from the break-even point when the business can become profitable, and set Benchmarks to achieve financial goals.

5. The procedure of a financial projection leads the company to see other scenarios of businesses in the same industry. Therefore it provides an idea of how the business is competing with others.

Simple financial projections template |

Startup financial projections template |

|

|

| Download | Download |

Financial projections template for startup excel

What are the Different Kinds of Financial Projections?

The financial projections are apportioned according to their necessity. Several types of financial projections are built every day to meet the financial need of businesses. Let us see the species of financial projections you can build according to your business requirement.

1. Financial projection for startups.

The financial projection for a startup is an estimation of the financial need and potential of the business group based on speculation. The business advisors use business theories and other financial policies to develop the financial projection. Not having financial history was never a liability for the startups, hiring a good financial advisor would be the key to starting the company with a budget and setting a financial goal.

2. Financial projection for an existing company.

Minimum of 3 years financial records are referred while drafting the financial projection of the same. For the existing companies, crafting financial projections is easier than the startups. The company could easily produce the past cash flow statement, balance sheet, income statement of at least 3 years using which the advisor could craft the estimated values of the same document of 3 years more.

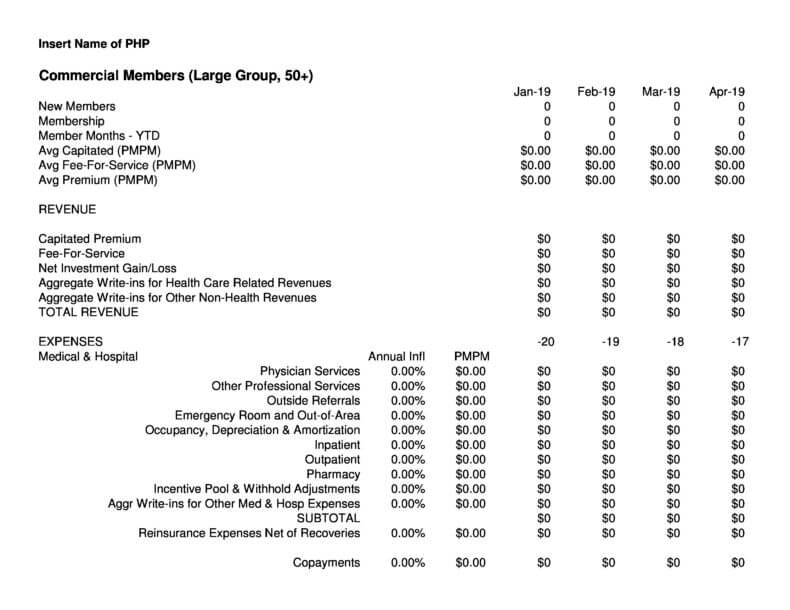

3. Financial projections 12 months.

Usually, when a company invests in crafting a financial projection, it extends up to 3 to 5 years. But some companies prefer to limit the financial projection to 12 months. These companies planned and organized to forecast the future revenue and expenditure of only a year.

4. 3-year financial projection.

A 3-year financial projection plan is the average length of a financial projection preferred by companies. The business advisors charge quite a money to craft the financial projections. Money is not the only factor running behind a 3-year financial projection. It is the concept that organizations follow and it is true to its extent. A 3-year financial projection is essential to unearth the potential of business growth.

Business plan financial projections template |

Financial projections for business plan |

|

|

| Download | Download |

|

|

| Download | Download |

How to Create Financial Projections for Startups?

Startups wonder how they could create financial projections when there is no background. The business that doesn’t exist would not have any financial documents. Due to this, the startup company wonders if it is possible to make financial projections. To answer this, we would say it is completely viable for a startup to have financial projections, but the process would be different.

The financial projections met for the startup are the educated guesses. It is based on market research, financial analysis, the information of government sources, industrial associations, statistics, and the financial basis of similar companies.

Suppose your startup company is an E-Commerce site trading with online transporting items. As a Startup, you have no financial record that would support your financial advisor bringing an estimate of your company, but you do have access to other industries and companies with similar trade policies. Good research of their statistics in a financial way could be a strong basis.

For existing companies, drafting the financial projections of the next 3 years is easy since they have the financial histories. But the company that has just started up does not have any financial history as a backup, they do have information of other companies. Hiring a good business advisor will be a good choice. The business advisor on the financial advisor knows exactly how to create the financial projections for your company using the external elements, so you could set a benchmark.

If you are ever confused about whether to build the financial projections for startups or not, then just go for it. No doubt in the fact that the existing company is largely benefited by the same. If not in the same proportion, but the financial projection does have a major contribution to make in the company since it helps the company to plan the budget, set a financial goal, and estimate the time above the break-even point.

|

|

| Download | Download |

How to Build a Financial Projection for a Business Plan or a Company?

The process of crafting financial projections would be different for an existing company and a startup. We have discussed the topic in the above section already so in this particular section of the process we would be talking about the procedure to create the financial projection for an existing company. Although the elements included in the financial projection for an existing company would be the same for the startup as well except the financial records available in existing companies.

1. Assemble financial documents.

a. If you are the business advisor, then the primary task would be to ask the company to provide the financial documents that hold information of at least three financial years. The compilation of documents will include profit and loss statements, balance sheets, cash flow statements, payroll, and other books of accounting.

b. Once you have each of these in your hand, assemble the documents at your convenience so you could get the required information in time.

The title head of the document must go at the top of it. For example- financial projections for the year…….

Mention the date of crafting as well, as it would be a good reference.

2. Begin the payroll.

The payroll is the document containing the employee’s list entitled to receive salaries and other company benefits. It clearly defines the amount of money or salary paid to the Employees.

a. Current year payroll.

In this payroll worksheet, incorporate the expenses made for the full-time employees, part-time employees, workers, and contractors. Break down the salary payment, taxes, employee bonus, employee pensions, and other expenses made behind the employees to find out the total average expenses. Using this document you could easily calculate the hourly wage, except the bonus, and reconcile it with the total expenses.

b. Estimated payroll.

After modeling the payroll of the current year, using your assumptions, you could easily find out the number of workers to be employed in the next year. Based on the data, you could easily calculate the salary payment, employee pension, and others and also find out the average hourly wages according to the staff types.

In a similar way note the factors and bring in the estimated and the current versions. Analyze and present the accurate form and eventually, you will see the financial projections in their original and authentic form.

|

|

| Download | Download |

If you have any DMCA issues on this post, please contact us!