When a customer, returns or refuses to accept a certain product, the seller issues a credit note addressing the buyer, instead of editing the issued invoice. While delivering the goods to the buyer’s address, the seller already put in the invoice with complete details of the purchase, therefore it is not viable to make changes in the receipt sheet. If the seller want they could make the changes on the copy of the invoice they have with them to record the sales return, but it is a complicated process. Therefore instead of editing the invoice issued, a Credit Note Template is addressed to the purchaser.

The credit note is also termed a credit memo, it is evidence of sales return. Using this document, the purchaser could purchase any item or service in the future. It serves as a gift card that allows the purchaser to buy any product at a particular price.

Table of Contents

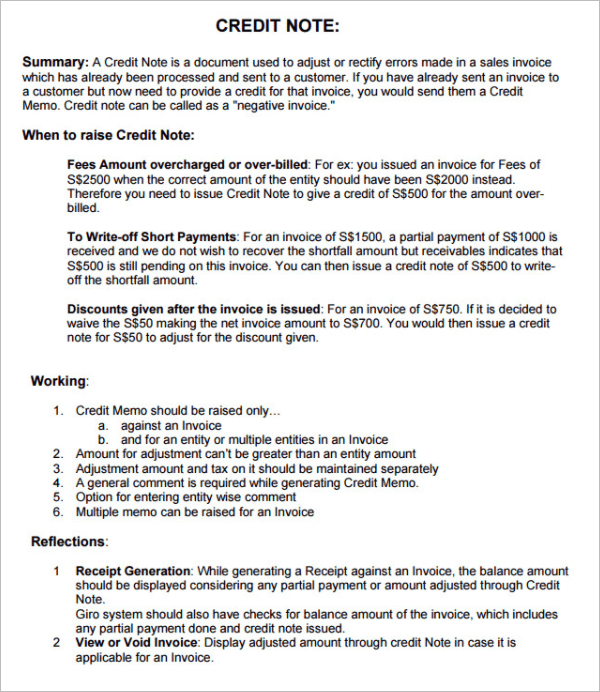

What is a Credit Note?

A Credit note template or credit memo is an official document issued by a seller to the purchaser informing them of the issue of credit. Unlike a purchase receipt or an invoice, the credit note makes the by your accessible purchase any product or services of the amount offered in the credit note.

The amount of money in the credit note is the exact amount which the purchaser has earlier bought any product or services from the seller but refused to receive it or return the same. Due to a number of reasons the seller issues a credit note addressing the buyer instead of refunding the amount directly to the bank account.

There exists some company policy, where the customer is not eligible to receive any refund or get the service of the amount transferred directly to the bank account but received a Credit note instead. The credit note is a convenient and error-free method that would require no such time but issuing a Credit note template by the company to the buyer using which the same buyer could make another purchase without having to pay the amount later.

Credit Note Templates

Credit Note Authorization Form |

Credit note format for service provider |

|

|

| Download | Download |

Credit Memo Template

What to Include in a Credit Note?

A credit note typically includes the elements of a price quotation. But unlike the quotation and invoices, the credit note only contains the information concerning the goods or services returned is the value of money to be refunded to the purchaser. There exists no strict format to follow while issuing the credit note template but it does include some Essential elements without which the credit note would not be considered as an official one.

1. Being an official document or credit note template contains the name of the company or seller, address, and contact details.

2. As credit note is addressed to the buyer, it would further contain the details of the purchase such as

- Name of the purchaser.

- Address of the purchaser.

- Contact details like contact number and email ID.

3. The reference number of the original invoice.

4. Description of the goods and services returned due to any reasons and its value. If there is a case of overpayment, then the value and the reason for issuing the credit note are specified.

5. The customer reference number.

6. The credit note number.

7. Date of issuing the credit note.

8. Reason for issuing the credit note.

9. Payment terms.

10. Shipping address or VAT number.

Besides these one of the important elements that a Credit note must not miss is the title head of the document. The document must be titled with the name of the document so it could be easily identified by the customer. Also if the VAT is incorporated in the original invoice, it needs to be e included in the credit note as well. It would be the matching VAT that would lay down the complete information of the original invoice in the credit note itself.

Although the aforementioned elements are essential in nature every company does not follow this format. There are companies that avoid providing the contact details and payment terms. But we recommend using it since it would keep you and the customer out of any confusion. If you wish, your company could incorporate in the terms and conditions and other provisions of accessing the credit note, or else the customer would be with an expectation of their own which is not applicable in actuality.

Credit Memo Format |

Credit Note Template Word |

|

|

| Download | Download |

Credit Memo Sample

Credit Note Template in PDF Format |

Free Credit Note Sample |

|

|

| Download | Download |

Credit Note Example in Doc Format

Credit Card Patyment Authorization Form

What Reasons Could Lead to the Issuance of a Credit Note?

Any number of reasons could lead the company to issue the credit note template in the name of the buyer. The most avoidable reasons for issuing the credit note templates are:

- The buyer has returned the goods or has refused to receive them.

- During transit, the product got damaged.

- The original invoice has an error in the payment section.

- The buyer wants to partly or fully cancel the advanced paid order.

- The customer wishes to change the original order.

- The purchaser has overpaid the amount through cash or by online transactions.

In any of the aforementioned circumstances, the seller of the product or the company would not be able to make any changes to the original invoice since it has been printed and issued. The modification in the original invoice would lead to nothing but confusion in the accounts of the company therefore the credit note template is issued to settle down the matter in a simple process.

When to Issue the Credit Note?

When there is an error with an issued invoice of the credit notes come to use. Due to the aforementioned reasons, the company would take about reissuing the invoice, but instead, issuing a Credit note template would be a much easier process to deal with this modification. Do you know when to exactly issue the credit note? The credit note could only be issued in the name of the purchaser when the purchaser has requested some modifications in the previous order. Also when the purchaser issues the debit note(request for credit note) the company is obligated to issue the credit note only if the refund is not under the policy.

The credit note is linked to the invoice issued earlier so there is a link with it. The purchaser could use the same credit note to purchase any product or services a letter from the company without having to pay the amount.

Therefore the company needs to issue the credit note templates if there is a requirement to refund the advance payment, cancel the existing order, or there has been a return of good or sales return. It is done to maintain smooth and accounting records without modifying the existing ones. The already issued invoices could not be raised from the accounts of the company therefore issuing the credit note is a better option since it will add in a new entry or information in the company accounts and would not create any confusion.

Credit Note Form Sample |

Credit Note Form Format |

|

|

| Download | Download |

Credit Note Requerst Template

Why Issue a Credit Note?

You might be wondering why issue a Credit note template when you can Readjust the things. But in actuality adjusting or editing things is not as easy as it seems. To make it the same as before as a company you would have to wipe off the invoice that has already been issued which is quite difficult in terms of the account. The technicalities involved in maintaining the book of account of the company would completely transform and is bound to create confusion later. So a Credit note is issued.

Here are a few of the reasons why a company must issue a credit note addressing the buyer.

1. It helps in settling down the matter without much processing.

2. The credit note is evidence of the settlement of the matter both to the purchaser and the seller.

3. The credit note allows the buyer to purchase any product or service equal to the value of the credit note in the future.

4. The credit note act as a gift coupon or a voucher issued in the name of the purchaser due to any number of reasons.

5. The service of the credit note makes the buyer feel secure as they would receive the money back in the form of a credit note.

6. It creates a sense of faith and trust in the company.

7. Which are the credit note, the purchaser could get their hands on any of the products or services obtainable on the website of the company anytime.

8. It helps the company maintain the general rules of accounting in the company since they do not need to wipe off the existing invoice.

9. The buyer is well confirmed of the amount we paid through the credit note.

It must be noted that the necessity of the credit note template appears more when the company has no explicit refund policy for products returned. In such a situation, the credit note is issued of value equal to the price of the returned products. Nowadays the credit note is given as an option to the purchaser as most of the companies have their explicit refund policy.

The customers prefer getting the money back in hand instead of receiving it as a gift card or credit note.

How to Issue Credit Notes in Different Circumstances?

Although the procedure of issuing credit notes is the same, the continent and the form of it might differ in different situations. The first thing to get your hands on before issuing a Credit note is a credit note template. You require a credit memorandum, so you could easily put the information and issue it on the address. If you wish you could create the credit note from scratch and use the original version, or else download a printable credit note template PDF.

A credit note template is a convenient tool used to fill in the information and issue the same without much time investment. You as a seller could choose your alternative.

Before explaining the procedure under different circumstances you must know that credit notes display a negative balance. It is just the opposite of the invoice. The amount that needs to be adjusted in the invoice is shown as a negative balance on the credit note to balance it out.

1. If the purchaser request to cancel the whole order, the seller needs to issue a credit note of the negative value of the amount canceled. Since the entire invoice order has been canceled, the corresponding amount must be incorporated in the credit note.

If the purchaser has canceled a few products, then the value equal to the products is mentioned on the credit note in the negative balance.

2. If the purchaser has paid the amount of the order in advance, you would probably have to return it, when the purchaser has to cancel it. In such a situation as a seller, you need to issue a Credit note to the purchaser of the value paid.

3. By any chance if the seller overcharges the customer by a certain percentage, a corresponding credit Note with a negative sum of the same percentage needs to be issued.

As the matter fluctuates, the actions taken against it also deposit. Therefore a company or a purchaser needs to make sure of the issue and only then adjust the credit note template.

a

|

|

| Download | Download |

If you have any DMCA issues on this post, please contact us!