Growing business merchandise and hoping to sell the credit stocks is a stable prospect. Working on crafting a Credit application form template could benefit you to more sales. Applying extension of credit services to customers is a means to bring them into your business and by using the technical method of credit application form, you make them recognize their needs. The more they need, the more they will make the purchase and eventually end up availing of your credit application service.

If the new consumers or the existing ones want to purchase any goods or services of your company, they would fill up the consumer credit application form with the necessary details. As soon as they submit the form to your website or send it through the mail, your hired employees would look into the matter, assess the details, see the possibility of recovery, benefit your company would be rendering, and then might approve.

Table of Contents

What is a Credit Application Form?

The credit application form is a document or a form issued by a company or a supplier to help the customer request credit. It is used in financial institutions and other credit agencies as well. The individuals who want to make a purchase on credit from a company or reap a loan from a financial institution fill the form with the necessary information as directed by the company.

It is a method applied by product selling companies to increase the number of existing customers and grow the business. But it only happens to be effective if the extension of credit does not increase the risk in the business. Till the tenure of return or reimbursement, the business applies its operating capital to balance it out. But the customer defaults bound the company to finance the money through the operating capital and thereby leads the business to incur losses.

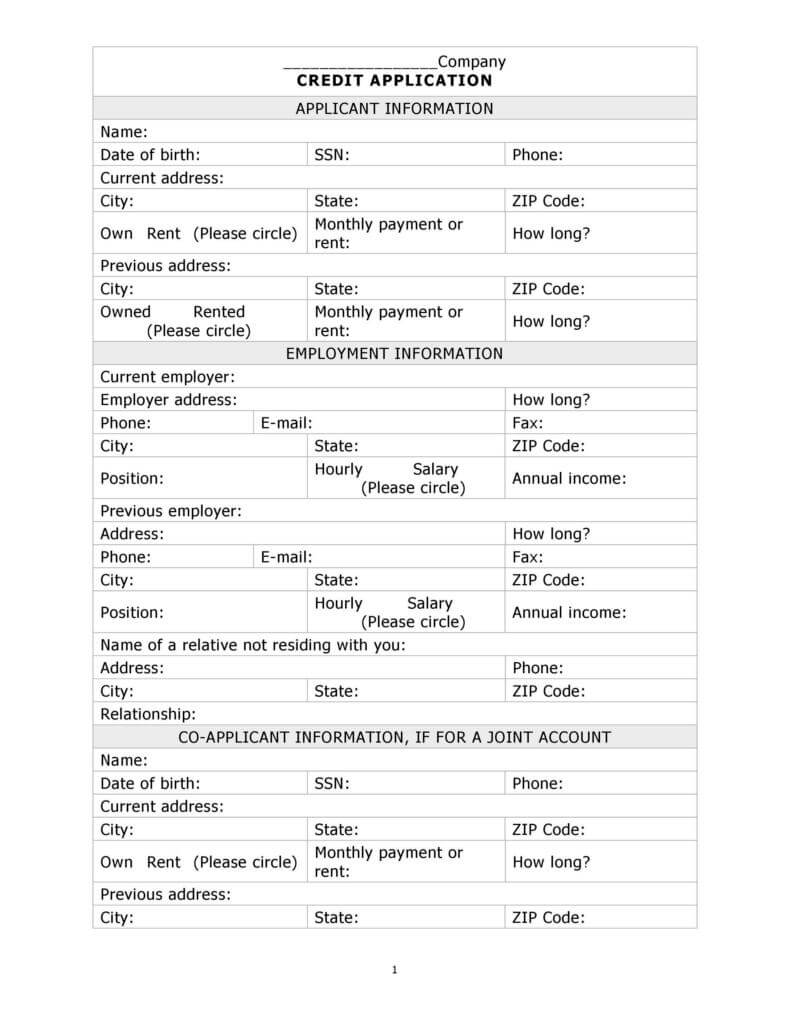

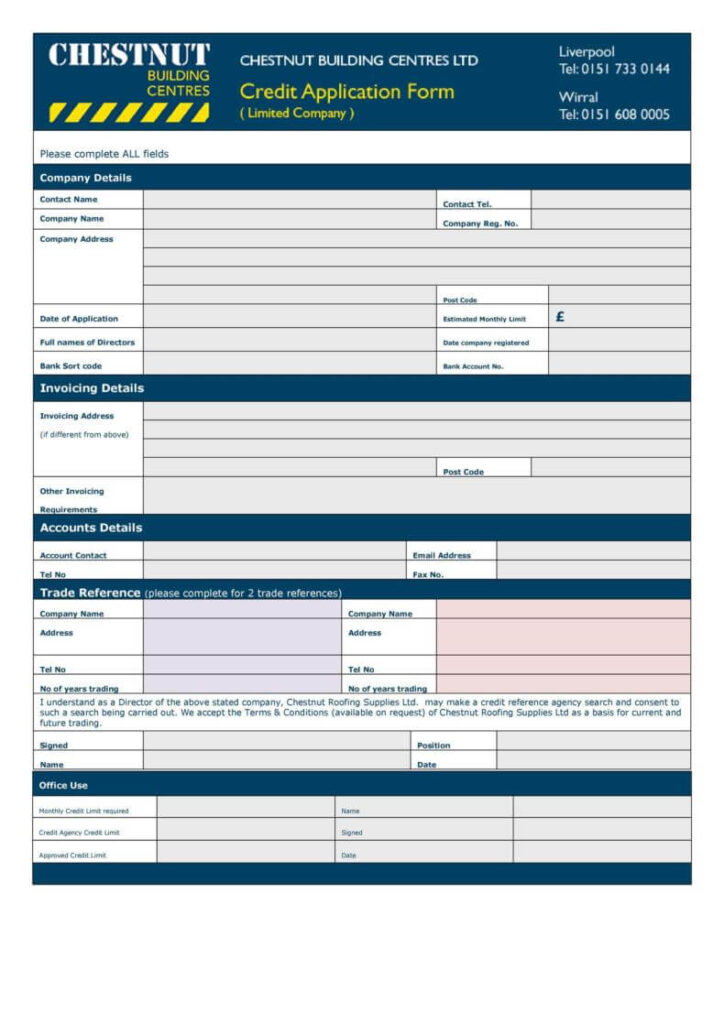

Credit Application Form Template

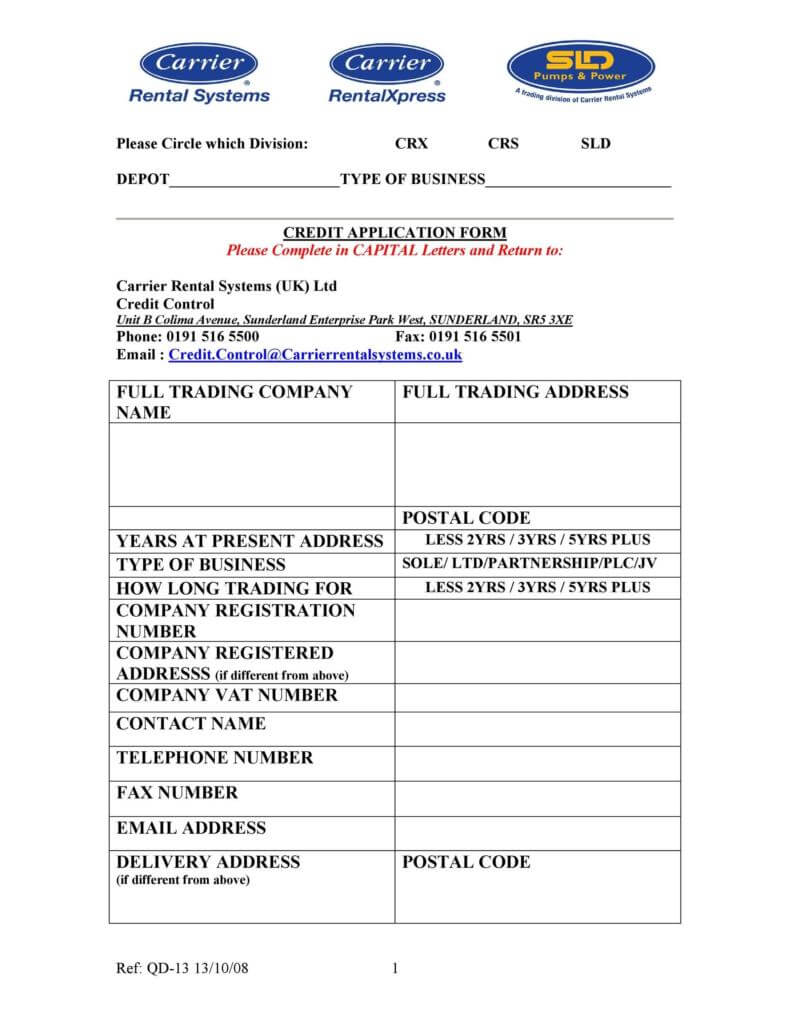

Example Customer Credit Application Template for Trade Account

Why does a Company Needs a Credit Extension Policy?

Adding a credit plan to your company for your customers is a great way to increase sales. Every company looks for new techniques and approaches so they could increase the number of sales and eventually maximize their profit. One of the ways is to extend credit policy where the customers focus on their needs rather than on the price and have a carefree purchase, without worrying about the interest. Don’t you think people love the service of credit cards they can purchase today and pay the amount later as per their convenience?

The credit extension policy has greatly impacted many recognized companies. The internet has evidence and studies that have proved so. Simple logic works in here.

If you lower the rate of interest, bring more convenient for the repayment, automatically it would attract customers, especially the small business houses or the vendors. Every supplier cannot purchase cash or check right then, instead, a credit extension policy released their attention and they could grow their business as well, which eventually benefits your company.

If you identify your objective as the business owner, it would help you to maximize the profit that will start with an increase in sales. Therefore, focusing on making the sale is more essential than thinking about the maximum profit right now. A great way to give it a start would be to provide a credible plan by issuing a credit application form template on your website.

Supplier credit application form

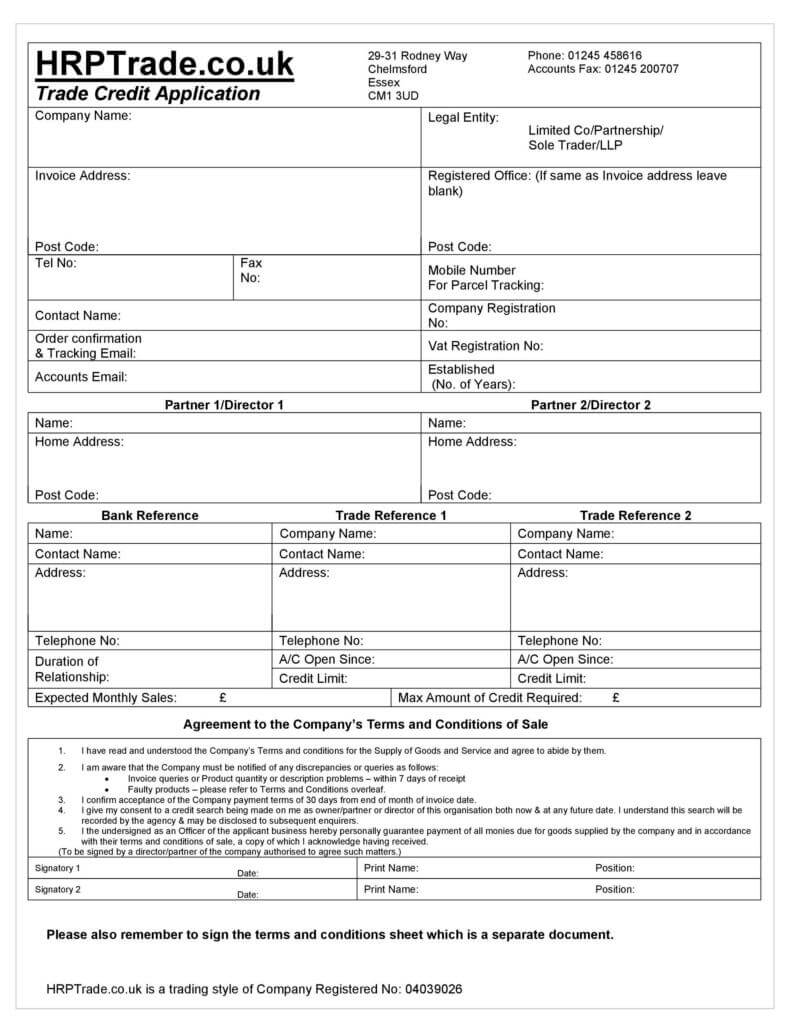

Trade Credit Application Form For Business

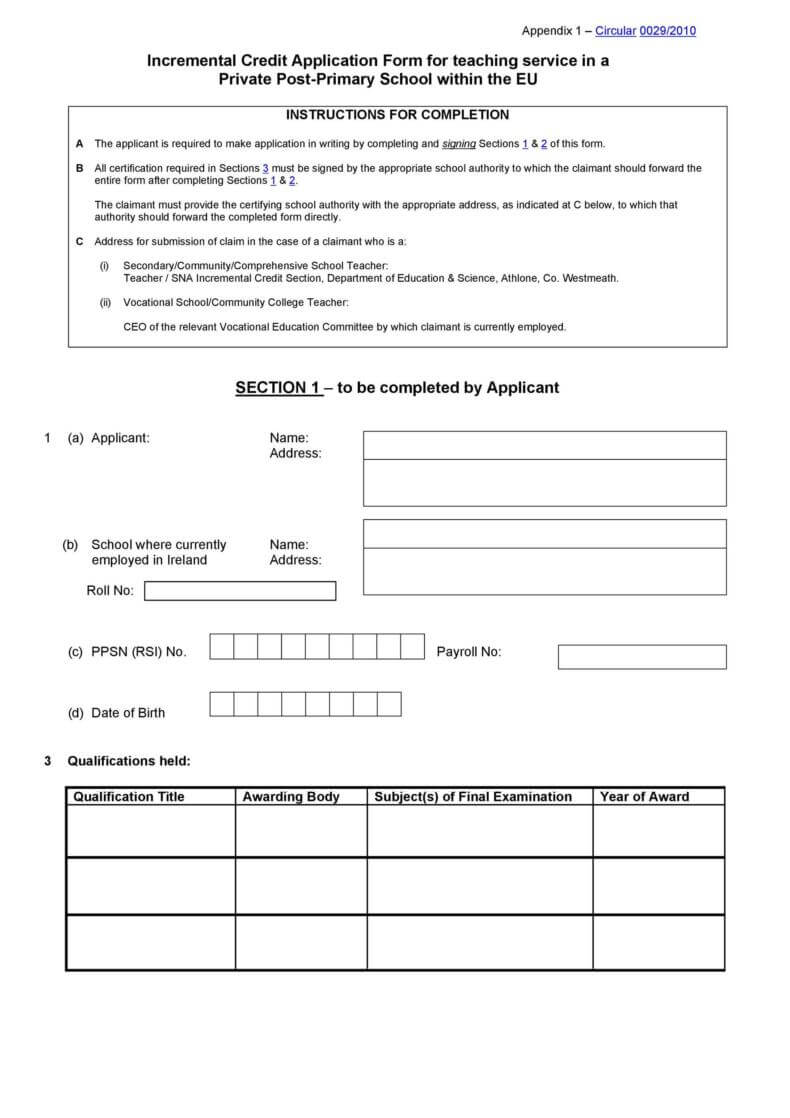

Significant and Necessary information to be included in a Credit Application Form

Credit application form can be used as legal document when necessary. So, it is extremely critical to pay adequate attention while crafting the credit application form. It renders different information and background information why it is being filled and why.

In a new customer credit application form template, you will need the customer details and other credit concerning the information. Extending a credit program to the customers will require some statements and documentation to prevent it from any defaults.

- Business information:

The customers would be the vendors for the retailers who will lead the products on credit. Therefore, detailed information concerning their type of business is essential. In the section of business information, you could ask for-

a. Company name.

b. Nature of business.

c. Kind of business – sole proprietorship, partnership, or joint entity.

d. Billing address.

e. City. State and zip code.

f. Phone number and fax.

g. Purchase orders.

h. Purchasing manager.

i. Year of establishment.

j. DEA registration number.

- Bank information:

The financial institution or the bank they use for their business transactions must be known by the credit servicing company, so they could enquire or try to recover any due amount by contacting through Bank. So, under the bank information, it is advisable to put the following blanks:

a. Bank name.

b. Type of account.

c. Account number.

d. Bank address.

e. City/ State.

f. Zip code.

g. Contact details.

-

Credit reference information:

As a reference, the customer needs to put up the business name and their contact details. Put the reference necessarily in the credit application form template as without it would be of no use. Therefore, make a table with 3 or 4 columns and more than 3 rows so the customer could fill in the name and other information.

-

Credit card information:

Just below the reference information comes the credit card information that contains the details of the credit card. Incorporate the following elements:

a. Type of card.

b. Name of the cardholder.

c. Card number.

d. Expiry date.

e. Signature.

-

Authorization:

Put a statement authorization at the concluding part of the business credit application form and put the following blanks below it:

a. Signature.

b. Date.

In the last paragraph, you could put the credit limit, account number, date, and the signature of the one who will approve the request.

The space you put for the customers to fill with the essential information will be accurately backed by some documentation as well. Without documentation, it is not viable for a company to record the customer request as valid. Proper documentation will be the proof or the evidence to see if the person is eligible to reimburse the money or the credit.

Apart from these elements, as a company, you should also request the applier of the credit application to attest the following. Consider it as some additional but crucial elements that you need in your credit application templates.

1. Verification of income.

Unless you comprehend the profit statement or the income certificate of the customer, would you be able to be assured of the return? Hence inquiring for the tax documents, the bank statements, is vital for the salaried person.

In the case of business individuals, you could demand the profit and loss statement, tax document, bank statement, and other financial records that prove the profit in the business with optimum transparency.

2. Addresses.

Irrespective of the nature of the customer, knowing the proper address and even the multiple addresses if they keep on shifting their places is essential. Despite having the contact details, the position of the residential or the business office address could help you reach the person if there is any scam.

Having the address of past years is a technical method to discern the credit report. In the case of monetary transactions in credit, pulling out the credit details of the customer is essential. Therefore, as a company or the credit service provider, you could undoubtedly ask for the company address, in the case of a business individual, and residential address of at least 2 years from now.

3. References.

References are evidence of the person’s valid existence. A normal individual or a social being must have some references either in the work field or business industry. In the reference section, they must put at least three valid references with their authentic contact information. Using the contact details, the credit giving companies contact them and verify the authentication of the business and the person.

The major objective of the reference is to enquire for information on business owners or the individual asking for credit if currently they have any existing debt in the market. This financial record would help you determine if to approve the credit.

Some instances could also call for detailed business activity references and trade references with proper valid baked up documentation to prove the credibility of the applicant.

4. Business policy.

Approving the credit service to a new business is no doubt a risk. But if your company is fine to provide the credit to the business owners who have just started in the industry might ask for some background information. Although, the startups cannot have much background information that would give as essential information in regard they would provide the business policy they have.

The existing business houses could easily provide their background detail that resembles well with their financial status. Documentations like profit and loss statement and balance sheet is a good way to comprehend a business’s financial condition, but background information is more helpful.

5. Identifying information.

All individuals have a social security number which happens to be the best way to prove the identification. For an individual, you could ask to provide the social security number and the employer ID, tax ID would be great for the business persons.

Do not ask for-

a. Gender.

b. Race.

c. Religion.

d. Caste.

There exist consumer credit laws and privacy policies that clearly state the elements not allowed. Dodge asking corporal questions that instigate discrimination. Then avoid asking such questions in the customer credit application form template.

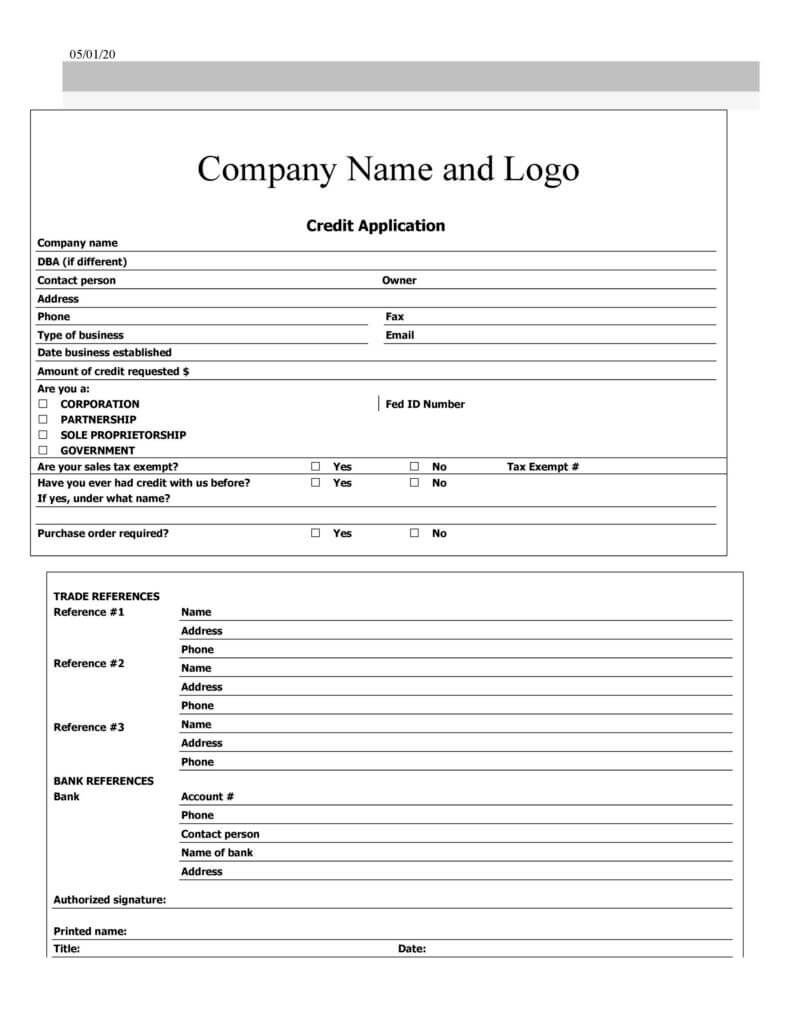

Distributor Credit Application Form Template

Commercial Service Vehicle Credit Application Free Download

Buyer Credit Application Form Template

Credit Facility Application Template

Auto credit application Form

Nursery Credit Application Form Template

Guidelines to Follow While Crafting the Customer Credit Application Form Template?

Forming the customer credit application form template is similar to the business credit application template, but a notable difference in its contents. On our website, you could find the free credit application forms at their types. Refer to it in case you are crafting the business application form template or other types.

While crafting the credit application form, knowing the elements and the format is necessary. Being a professional and legal format seen as an agreement, any issue in the format would lead your company to the future risk. To learn the method to craft the credit application form template, consider consulting the below mentioned points:

1. Put the Title head.

At the top of the document, provide the name of your company, and on the successive line, the title head, i.e. Credit application form template.

If it is the business application form or other credit application form type, then include the respective names.

2. Elements in a sequential format.

Just as we have shown the logical order in the section of the elements of the credit application form template, include the following in your document as well. You can add some more elements besides the ones we mentioned, but they should go under the proper head.

3. Tabular format.

It is on the author how they want to present the free credit application form template. To have an arranged manner, you could prepare a tabular format. In the table, using the rows and columns, you can easily segregate the heads and the blanks beside it.

Or use both the format, if you wish to.

Suppose, at the start of the document, you have put the bank information, and the credit information in a usual mode, but in the section of references, you could easily attach a table where they can list down the name of the references along with their contact information conveniently.

4. Proofread.

No matter which documents you wait for your company after the process is over, proofread the same. It helps to bypass any errors. Avoiding this step in the entire method could lead to a serious issue and the responsible what would be the company and customer. Therefore, proofread the document and make the improvements if necessary.

5. Highlights.

The terms and conditions usually come in small letters. But if you want to change the time it is best to highlight the terms and conditions so the customer and the company could avoid any problems. If there are elements in the credit application form that you want the customers to point out, you can highlight them.

Personal Credit Application Form

Free Auto Credit Application Form PDF Format