The term reimbursement means “Compensation”, and the employee expense reimbursement is the amount reimbursed by the organization to the employees of the business expenses incurred. The out-of-pocket expenses are compensated by organizations on a timely basis. Seeing the information on the employee expense reimbursement form, the company outlines the total compensation.

The expenses the employees had to pay for on behalf of the company due to business travel and other operations are paid back by the organizations. This process of compensating for the amount out of pocket is called a reimbursement.

The expenses are paid for legitimate reasons only, therefore in the process, the employee expense reimbursement form works. The reimbursement form is submitted by the employee itself showing the invoices of the expenditure done. Both the invoices and the record of the employee reimbursement form resemble if the matches the total amount is compensated to the employee. It is to be noted that the reimbursement amount is not subjected to taxation.

Table of Contents

What is the Employee Expense Reimbursement Form?

An employee expense reimbursement form is a document submitted by employees to the organizations that provide the calculation of expenses paid out of pocket for business purposes. Along with the employee reimbursement, the possible invoices are produced as well that works as proof of the expenses accrued by the employee.

At a certain time, the organization reimburses the expenses paid out of pocket. The service is not the only constraint towards the employee who has been out of the station for the work and had to incur expenditure for the same. It is equally outlined in the company policy for any individual if the final consumer or any third party is involved. Each company is obligated to compensate the expenses that have been done on behalf of them but not directly taken from it. The individual has spent the money from their pocket and later the company is paying them the actual value they have spent for the business purpose only. The entire process is called the employee expense reimbursement.

Additional information to note about the reason is that it is not subjected to taxation. Therefore the amount reimbursed to the employees is free from taxation.

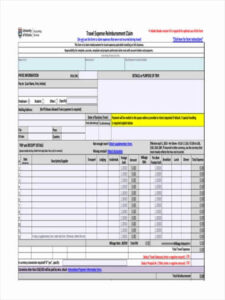

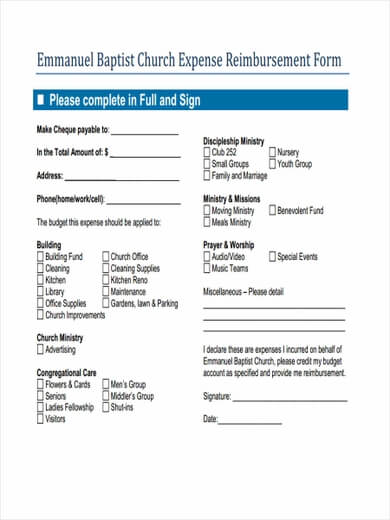

Employee Expense Reimbursement Forms

|

|

| Download | Download |

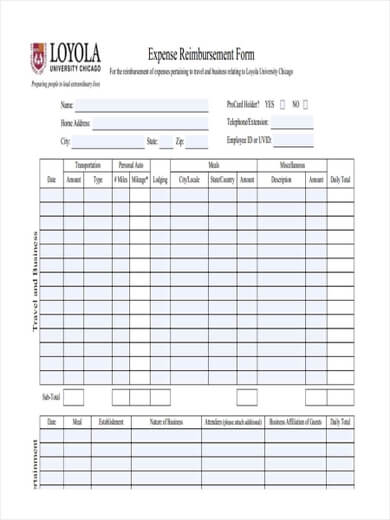

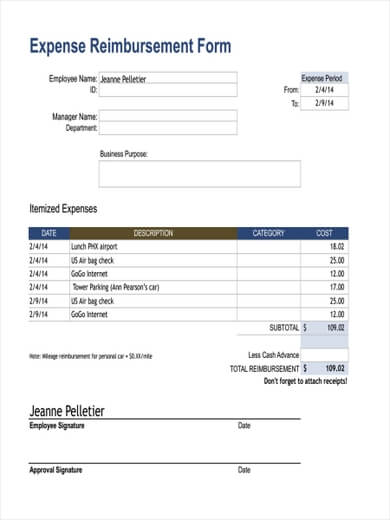

Employee Expense Reimbursement Forms in Excel

Business Expense Reimbursement Form Template |

Medical Expense Reimbursement Form Template |

|

|

| Download | Download |

How Does the Process of Reimbursement Work?

What is the Employee Expense Reimbursement Policy?

The reimbursement process is easy to operate and understand. An individual is either an employee of the organization, customer, service provider, or any third party if had to pay an amount for the company, the organization is obligated to pay back the same amount, this is called reimbursing, where the company is subjected to repayment or compensation.

The process exists because often the employee of the companies are sent out to have a business meeting or a business deal with international or national companies. Since the employee has to take the responsibility because the company asked the employee to, the responsibility of stay and food is on the company. There could not be any fixed budget of the business travel for which the company would hand over a certain amount of money to the one appointed for the work. Therefore the process of reimbursement is introduced in the company policy so that the employee could spend the required amount of money for the business travel food and stay, and later when they come back they use their recorded expenditures and craft the employee expense reimbursement form and hand it over to the organization, attested with the possible invoices.

After assessment and evaluation, the company checks the entire amount and reimburses the money to the person.

Apart from reimbursing for business travel, there are several other kinds of reimbursement too. In the insurance industry, in taxation, the company reimburses money too, we will find it out in the next section.

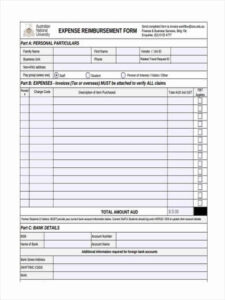

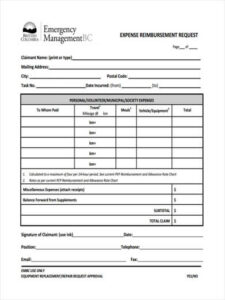

Reimbursement request form

Employee Expense Reimbursement Form Sample

General Expense Reimbursement Template |

Candidate Expense Reimbursement Form Template |

|

|

| Download | Download |

Expense reimbursement form template

Employee Expense Reimbursement Form Example

What Type of Reimbursement does Company Endure?

or

What Expenses Can Be Reimbursed by an Employer?

The insurance amount, the tax overpaid and other business expenses are the general examples of the reimbursement. Hence the reimbursement has been categorized into three parts-

- Insurance.

- Taxes.

- Legal.

1. Insurance reimbursement.

As aforementioned above, business reimbursement is not the only kind of reimbursement. In the field of insurance-Health Insurance, when the policyholder is in immediate need of money, they might not get the insurance money immediately. In such a case, the policyholder decides to bear the medical expenses out of pocket. But since it is the responsibility of the medical insurance company to pay the money for the medications and other medical treatments in the Nursing Home and Hospital, the Insurance Company reimburses the money to the policyholder.

The policyholder needs to file for the reimbursement to the insurance company and when it’s time the company would analyze and the expenses that come under the policy and reimburse the money to an extent.

2. Taxes.

Often the taxpayers overpay the taxes, due to this the taxation department reimburses the overpaid money back to the taxpayer. This is how indexation reimbursement occurs. When the taxpayer paid the excess tax due to any reason in the form of TDS or TCS, they are subjected to get a tax refund. At the time of filing the ITR, the taxpayer could claim for the excess money. On such a request, the taxpayer is reimbursed the excess money paid.

3. Legal.

You might have heard of the term alimony in legal cases. Alimony is a kind of reimbursement. At the time of separation, the other half could demand the alimony and on the order of the judge, the person is bound to pay the same. Although it has some criteria to fulfill, once it comes under the same, the other half in the marriage is applicable to receive the alimony for the money to be reimbursed.

These were the three aspects where reimbursement is involved. So other than the business reimbursement, in the field of insurance taxation and legal range the reimbursement works in various forms.

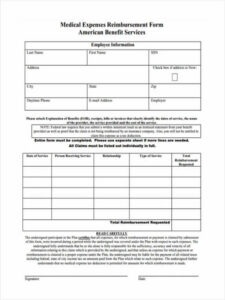

Moving Expense Reimbursement Template |

Expense Reimbursement Request Template |

|

|

| Download | Download |

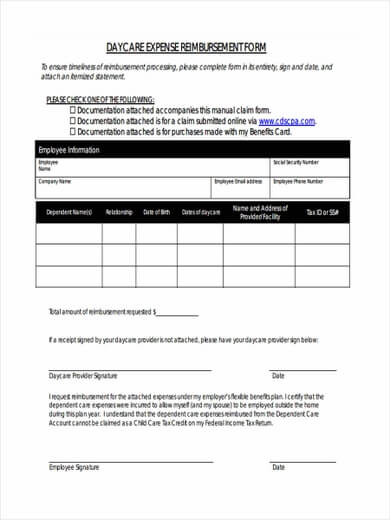

Daycare Expense Reimbursement Template

Healthcare Expense Claim Form Template

Expense Payment Reimbursement Template |

Parking Expense Reimbursement Template |

|

|

| Download | Download |

How Long Should You Wait for Expense Reimbursement?

As the fact states, on average a business could reimburse expenses within 9 days. Some businesses might take a week or two to process the employee expense claim after being notified by the Employee Expense Reimbursement Forms. The employees paying the expenses out-of-pocket has to suffer as they could not approach for the expense to the business to be in the good books nor could they ignore the problem. It is the responsibility of the business on the employer to look into the fact so the employees do not suffer because of their processing delay.

Having said that the business faces some issues due to which they might hold the expense reimbursement. There are many issues a business could face- approval legs, sloppy submitting, reimbursement hold-ups, and many others. So as an employee, you could wait or request your employer to reimburse your expenses as soon as possible and they would do it if they are free of any valid issues.

Commuter Expense Reimbursement Template |

General Employee Expense Reimbursement Form Template |

|

|

| Download | Download |

If you have any DMCA issues on this post, please contact us!