Keeping an account of the debit and credit balances in a business is done using a general ledger template. It records the company’s financial data concerning the transactions operating in a business, thereby helping the auditors and accountants prepare the financial statements.

The company’s financial statement is based on the general ledger; therefore, it could be considered as the foundation of accounting. The storing of the financial data and transactions in the general ledger help organize the segregated elements of the ledger accounts and bring up the trial balance. The summarised financial data or the trial balance showcases the balances of all accounts of the ledger. Both the debit and the credit balance in a trial balance statement should be equal; if not, there could be some error, or else the difference is transferred to the suspense account.

In all of these records of the debit and credit balances in the trial balance, the ledger is the crucial financial statement that helps the company ascertain the arithmetic accuracy and locate the error.

Table of Contents

What is a General Ledger?

A general ledger is a book that contains the summarised form of all transactions in a business. It is prepared from the journals and later, the trial balance is drawn from it. Therefore it is also termed as the principal book of account.

The major purpose of creating the general ledger template is an assessment of the money earned and the expenses incurred. It could include revenue in the form of collection from the debtor, bad debts recovered, whereas expenditures include cash paid to creditors, the dividend paid, purchase of furniture, etc.

The general ledger, a perpetual document is maintained throughout the year and as long as the business exists. Creating the book of account, the general ledger could never go off in a business since it is the basis or the foundation that generates other financial statements in a business which helps to ascertain the profit and loss. So general ledger and the differences reached by subtracting the debit and credit balances are the formulations used in preparing the trial balance and the final accounts.

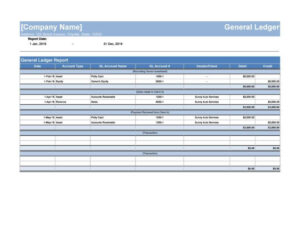

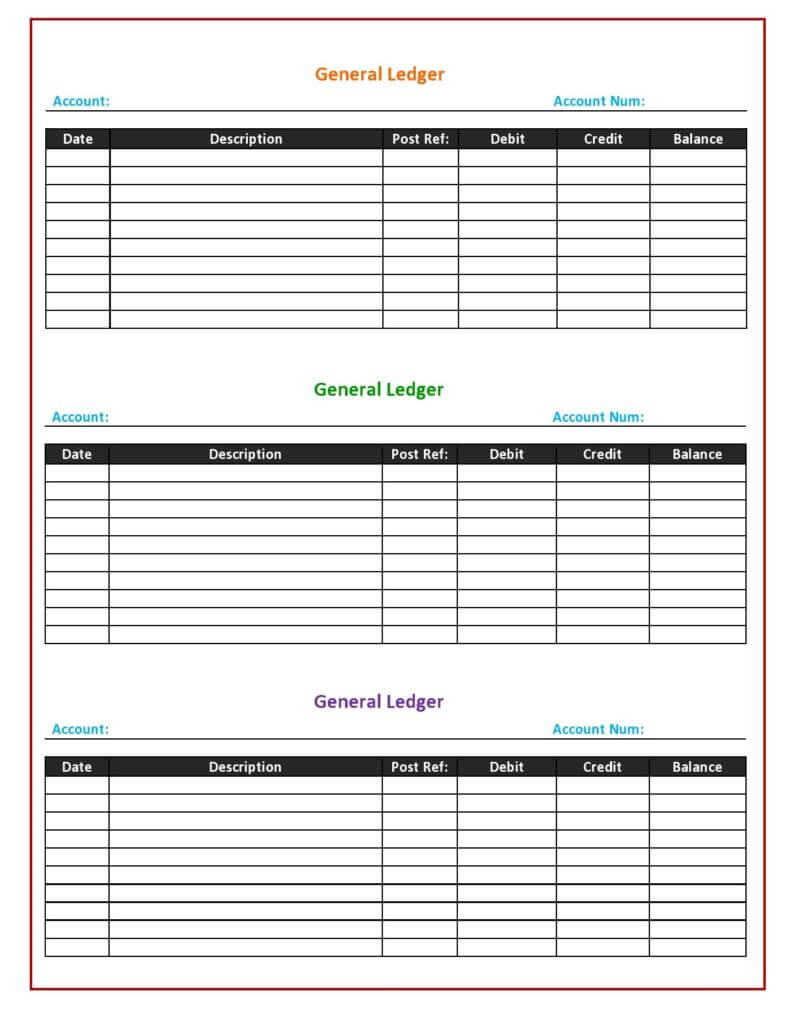

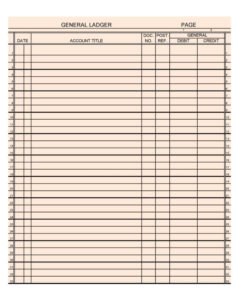

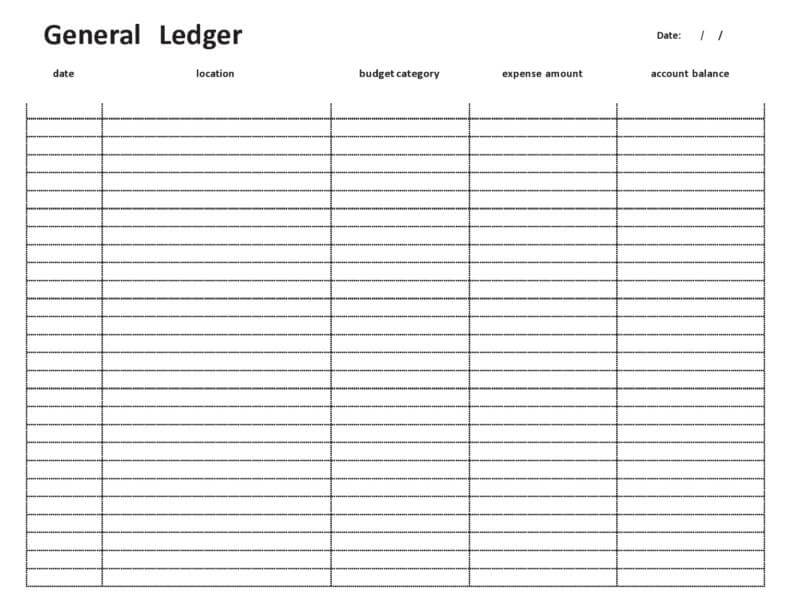

Sample General Ledger Templates

|

|

| Download | Download |

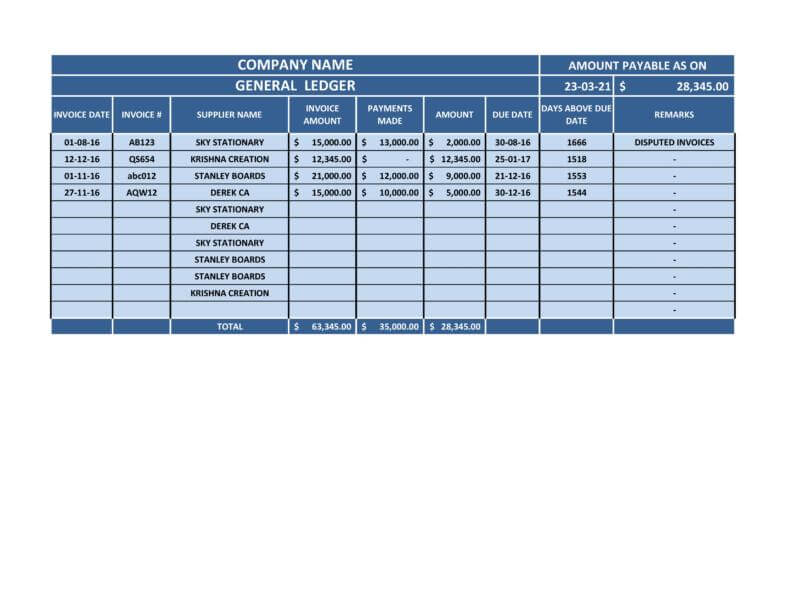

|

|

| Download | Download |

General ledger template word Format |

General ledger template excel Format |

|

|

| Download | Download |

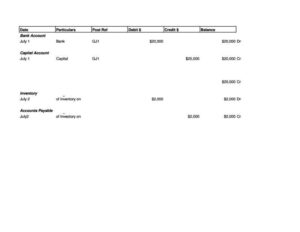

What Makes a General Ledger an Accounting Document?

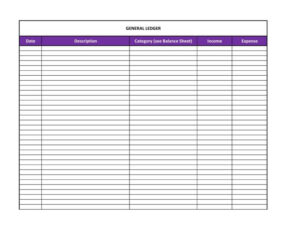

In the general ledger, when an account is opened, it consists of in total 8 columns. These are divided into two categories, one of which is the debit side and the other is the credit side.

The debit side of the general ledger includes the-

- Date– to record the date of transaction.

- Particulars- to name the accounts transacted.

- Folio- denotes page number of a journal entry.

- The amount and the same goes to the credit side of the general ledger template as well.

Using these four elements on the left and four elements on the write the entire ledger template it is prepared.

Each of the elements in the general ledger template is treated differently, according to the moves of the modern accounting rule. The mechanics of posting the transactions in the accounts are different as well.

- When any asset account like furniture, land, and building, plant and machinery, patents, inventory, etc., is prepared in the general ledger template- an increase in assets, the account is debited. On the other hand, if the acid decrease, the account is credited.

- In the case of any liability account like creditors, accounts payable, outstanding expenses, loan- any decrease in liability leads the account to be debited, whereas if the liability increase the account is credited.

- If you prepare the capital account of any partner or proprietor- debit the account if there is a decrease in the capital, and credit card account if there is an increase in the capital.

- In accounts of income and gain(revenue account) like sales, interest received, etc.,- the account is debited with a decrease in revenue and credited with an increase in revenue.

- Lastly comes the expense account that is wages paid, depreciation, purchases, rent, salary, etc.,- the account is debited with an increase in the expense and credited with a decrease.

This is what goes into the general ledger template and this is how the different accounts are treated.

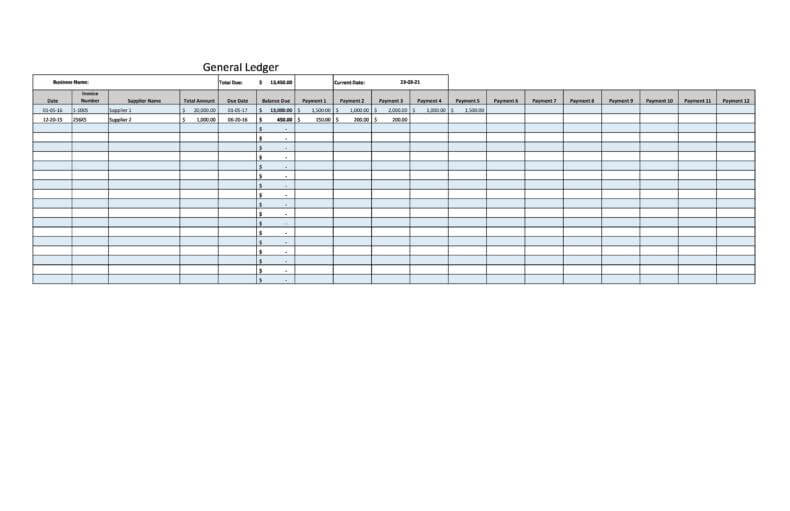

|

|

| Download | Download |

|

|

| Download | Download |

What are the Categories of Ledger accounts?

The effect of transactions is summarized in 5 ledger accounts. Each of the segregated ledger accounts has a different effect on debit and credit. The golden rule of accounting is applied to summarise the effect of transactions in the ledger account.

Here are the five elements of the ledger account.

1. Assets.

2. Liabilities.

3. Capital.

4. Revenues.

5. Expenditures.

Some of the examples of those 5 elements of the ledger account would help you understand better. So here it is:

a. Cash account shows the liquid assets of the business.

b. Sales account shows the number of sales in a year.

c. Accounts receivable that showcases the money the debtors owe to your business.

d. Accounts payable showcases the money that your business owes to creditors.

e. Inventory account is an asset account that displays the effect of purchase and sale in your business.

f. Stock represents the value of stock in the business.

g other nominal account shows the sources of income and expenditure.

Majorly the financial position of a business is using ledger accounts.

|

|

| Download | Download |

|

|

| Download | Download |

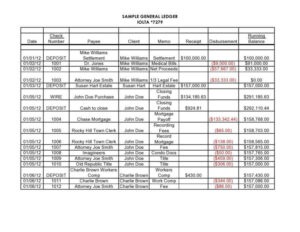

How Does the General Ledger Work?

As mentioned earlier, the ledger is the basis of accounting. It is the master record of the business accounts prepared from the journal and thereby, shows the current balances in all accounts. But we must know how this works and how it affects other business accounts.

At first, using the transactional receipts, the journal is prepared. Looking into the journal the sub-ledger all the ledger accounts is prepared. The difference is of the debit and credit balances of all such ledger accounts are then summarised in the general ledger template. It showcases the debit and credit balances in the business.

Past then, using the general ledger template the auditors are the Accountants hired to keep account of the financial transactions creates the trial balance. The trial balance serves as the report of each ledger account. The trial balance help in locating errors, ascertaining the Arithmetic accuracy, and then adjusting the difference is with the necessary entries.

Now the trial balance is the basis of accounting using which the accountants prepare the final accounts to ascertain the net profit and loss. The profit or loss ascertained from the final accounts of the business is further utilized in forming the balance sheet of the business as well. Other financial statements of the business are too created using the trial balance sheet.

This is entirely how the general ledger template works in a business. Through this, you must have comprehended that without crafting the ledger accounts and formatting the general ledger template, no financial statements of business could be generated. We could lay down other business reasons as well if you are wondering why your business needs the ledger accounts.

|

|

| Download | Download |

Why Does a Business Need a General Ledger Account?

Convincing you for creating the general ledger template is not a challenging task rather it is too easy. Just think would you rather not maintain the ledger accounts than create them to generate other financial statements in your business. Whatever your business would need has to be done to keep the book of account. Let’s take a deep dive into the reasons:

- The general ledger template helps the investors, stakeholders, accountants, and others and in a business evaluate the company performance.

- It provides an accurate record of the financial transactions in a business.

- The preparation of trial balance and final accounts.

- The accountants draw the information from the ledger account to curate the business financial statements.

- The auditors and accountants could easily locate the errors by going back to the ledger accounts. Although the journal is available but fumbling around the journal entries complicates the process; therefore the ledger accounts are helpful.

- The ledger account helps identify any fraudulent cases and rectify them.

- The unusual transactions could be easily identified through the ledger accounts.

- It showcases the current balances of all accounts.

- It largely contributes to evaluating the profitability and the financial health of the business. It also is an investment in assessing the business liquidity.

Besides these reasons, the ledger accounts assist in the income and expenditures of the business in a single place, making it easier for the business to file the tax returns. Being the holder of so many significance, why would any company not invest their time in preparing the general ledger template when they are the staircase of other business financial statements.

The general ledger template is quite convenient to use and easy to format since it is in a customizable state. Download printable general ledger Excel template and use it to its utmost.

Accounting General Ledger Template |

Accounting General Ledger Excel Template |

|

|

| Download | Download |

|

|

| Download | Download |

If you have any DMCA issues on this post, please contact us!